or

On March 5, 2020, the Ministry of Finance, on receipt of application from the Reserve Bank of India, exercised its power under sub-section (2) of Section 45 of the Banking Regulation Act, 1949 and issued Order of Moratorium1 against Yes Bank Limited. This resulted in a ripple effect in the already stricken stock market, tumbling the share price of Yes Bank Ltd. to record low Rs. 5.55.

Although the Order of Moratorium which was initially set to remain operative until April 3, 2020, imposing certain restrictions on the banking business of Yes Bank, one of which is limiting the withdrawal limit for depositors up to Rs. 50,000 only, leading to panic among the depositors of Yes Bank; has been lifted on March 18, 20203. In addition to the order as mentioned earlier, the RBI exercising its power4 under the Banking Regulation Act, 1949, initially superseded the Board of Directors of Yes Bank Ltd. for 30 days period5. The reasons cited in the official statement of the RBI6 for these drastic yet necessary steps taken can be encapsulated to the steady decline of the financial position of Yes Bank. Yes Bank’s financial instability is a result of its failure to raise capital to address the NPA losses incurred, the severe governance issues and a regular outflow of liquidity. From having only 1% of bad loans and NPAs to Order of Moratorium and RBI superseding the Board of the Bank, one can wonder what happened at Yes Bank Ltd.

Yes Bank Ltd. is a commercial bank which was founded by Rana Kapoor and Ashok Kapur in 2004. Until late 2017, it held a substantial market capitalisation; however, it witnessed a steady decline in its market share, resulting in market capitalisation of just Rs. 5,876.29 crores7. The story of its decline is reminiscent of the Sub-prime mortgage bubble, which lead to the global financial crisis of 2008. As with great power comes great responsibility and Yes Bank Ltd. failed to realise the responsibility of bearing the losses when it subjected itself to aggressive loan exposure towards stressed companies such as IL&FS, Anil Ambani Group, CG Power, Cox & Kings, Café Coffee Day, Essel Group, Essar Power, Vardaraj Cement, Radius Developers, and Mantri Group.

Yes Bank mainly focused on issuing corporate loans to aforesaid companies at much higher rates than usual, which led to the fast-paced growth of the Bank but in the long-run exposure to such borrowers resulted in massive accumulation of NPAs for Yes Bank and it incurred huge loses. Yes Bank to seize a higher rate of interest instead of taking the consortium way of issuing loans preferred to deal directly with the promoters of the borrower companies.

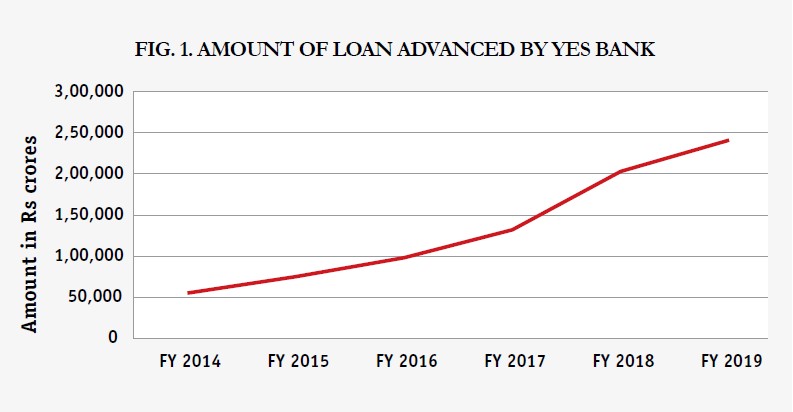

In FY-2014 to FY-2019, the total loan advances by Yes Bank swelled by 334% which is the highest increase among all the banks during that period8. The Fig.1 below plots the increase in loans made by Yes Bank since FY-2014.

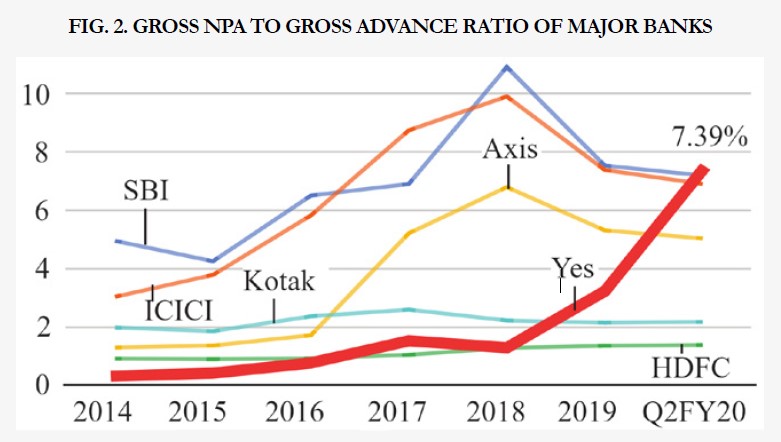

As per the Fig.2 above, it can be inferred that Yes Bank’s Gross NPAs, i.e. loans overdue for more than 90 days increased to 7.39% as of September 2019 which is the highest among the comparable banks in the table.

To make matters worse, in the FY 2018-19 RBI, upon scrutiny the RBI found a divergence of Rs. 3,277 crore between the reported Gross NPAs by Yes Bank indicating that it is underwriting its NPAs. The report revealed that Yes Bank was under-writing the NPAs in its Balance Sheet, which resulted in the violation of the regulatory compliance as the financial statements of Yes Bank Ltd. failed to show the true and fair picture of the financial position of the banking company. The deteriorating financial position of the Bank due to huge NPAs and poor compliance culture prompted the RBI to sack the CEO Rana Kapoor, and on January 23, 2019, Ranveet Gill was appointed as MD & CEO of Yes Bank.

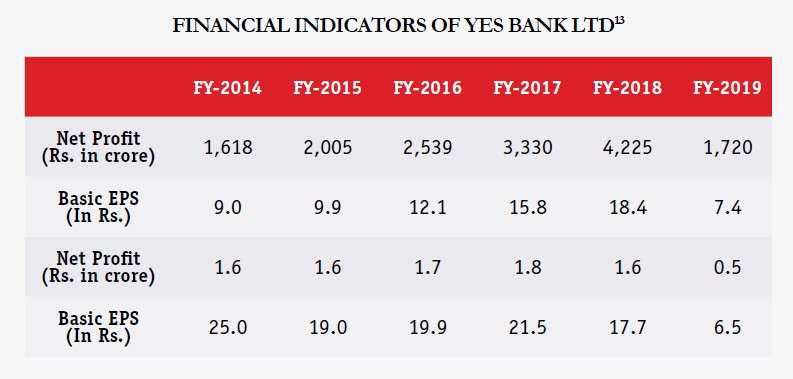

As per the above table, it can be inferred that by the time appointment of Mr Ranveet Gill was made, the banking company was running in huge loses and financial stability was crippling. Yes Bank initiated a series of equity funding rounds but failed in materialising any deal for the infusion of capital. In this matter, RBI also took the Bank and market-led revival route rather than a regulatory restructuring and granted ample opportunities and extensions to Yes Bank to secure such equity investments. Furthermore, in the meantime, the Banking Company was subject to a regular outflow of liquidity and coupling NPAs.

Hence, RBI stepped in by obtaining the Order of Moratorium with an order to supersede the Board of Yes Bank Ltd. RBI, on March 6 2020, to revive the operation of the Bank and maintain the trust of depositors, notified a draft scheme of reconstruction named “Yes Bank Ltd. Reconstruction Scheme, 2020”14. The draft scheme was approved by the Government of India and was enforced on March 13, 202015. The reconstruction scheme altered the MOA of Yes Bank Ltd., mainly the Capital Clause, increasing the Authorized Capital up to Rs. 62,00,00,00,000 (Rupees Six thousand two hundred crores only).

This alteration was effected by infusion of equity in Yes Bank by State Bank of India, resulting in fiscal stability of the Bank. Nevertheless, the principal criticism of the reconstructions scheme is the dealing of instruments qualifying as Additional Tier-1 Capital (AT1). An AT1 capital bond can be defined as an unsecured hybrid debt instrument with no fixed maturity period, i.e. they are perpetual bonds having no redemption date and carry a call option. The concept of AT1 bonds was introduced as per the Basel III norms after the 2008 global financial crisis to ensure the liquidity of banks.

As per the Clause 6 of the Draft Reconstruction Scheme, the RBI proposed that on and from the appointed date from which the scheme comes into force, all the AT1 instruments issued by Yes Bank shall be written off from the books which shall result into wiping out of investments made in these instruments by Mutual Funds, financial institutions and pension funds. This treatment of AT1 instruments is challenged in the Bombay High Court by the Axis Trustee Services on the ground that preference given to equity of AT1 instruments in against global best practices and benefits the promoters of Yes Bank Ltd. over the bondholders’.

Although, Yes Bank is not a Domestically Systematically Important Bank (D-SIB) as identified by the RBI, however, the size of its balance sheet is the reason that RBI is taking all the necessary steps for its revival. The drastic action taken by RBI’s was a temporary yet necessary measure to safeguard the depositor’s interest and maintain the confidence and stability of the financial system. As the approved reconstruction scheme constitutes a new Board of Directorship appointing former CFO of SBI, Mr. Prashant Kumar as the CEO and MD, the intention should be of restarting the operations of the Bank focused on the retail banking.

The approved capital restructuring was achieved by SBI acquiring 49% of the shareholding of the Yes Bank. As per the approved scheme, the holding of SBI in Yes Bank’s capital shall not be less than 26% before completion of 3 years. The approved scheme also mandates a lock-in period of 3 years for the existing shareholders having 100 or more shares. This retrospective prohibition is an unprecedented step primarily affecting the minority shareholders and requires further regulatory clarifications from the government.

Although Rana Kapoor was arrested on March 7, 2020, by Directorate of Enforcement and is charged on the grounds of financial mismanagement and irregularities, the Yes Bank fiasco highlights the cracks in existing banking regulations. The current position of once India’s fourth-largest private Bank and the Punjab & Maharashtra Co-operative Bank Ltd. (PMC Bank) raises severe flaws and lacunae in the compliance framework in the Indian Banking sector. The crisis raises allegations against the compliance monitoring by RBI as it failed to notice the jump of 35% in loan granted by Yes Bank in a single year and failed to react promptly when the Bank incurred massive loss in Q1 of 2019.

It highlights the need for efficient and a permanent framework for dealing with such emergencies. This can include the establishment of a fast track resolution mechanism for banks which may be introduced with the introduction of the Financial Resolution and Deposit Insurance (FRDI) Bill. Another step that can be undertaken is carrying out Asset Quality Review (AQR), a clean-up exercise as done by RBI in 2015. The Indian banking sector needs systematic reforms as it is facing an NPA crisis as highlighted by Yes Bank case.

Tags: UnComplycate

Jayashree Swaminathan is currently working as the Chief Executive Officer at UnComplycate. With over 30 years of a proven track record advising corporates on their governance, risk and compliance mandates, Jayashree has been eyeing at a visionary approach to create a 100% compliant India Inc. With compliance as per passion, she possessed added skills in terms of business acumen in form of improving the financial performance, operating efficiency, cost control, revenue enhancing initiatives, practical system improvements, business development enhancement capabilities, etc.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved