or

With the second wave of COVID-19 aggressively enveloping India, the efficacy of the vaccine in controlling the pandemic becomes crucial. Various pharmaceutical and biotechnological companies are investing heavily in terms of time, effort, and resources for finding a workable and an effective vaccine that can help control the pandemic. While India is anxiously waiting for such a solution, the financial planners and the top management of these pharmaceutical and biotechnological companies, I am sure, would be very keen about how their investments towards researching and developing the COVID-19 vaccine would be valued and treated in their books of accounts. This becomes crucial given the fact that if the investments are capitalized and represented on the balance sheet of the company as an asset, then it would produce a lot of positive benefits including being able to raise additional finances and having more valuation, etc. Alternatively, if it were not identified as an asset, then such expenditure would have to be treated as revenue expenditure, which would bring down current profits, reduce retained earnings, and thereby reduce the size of the balance sheet.

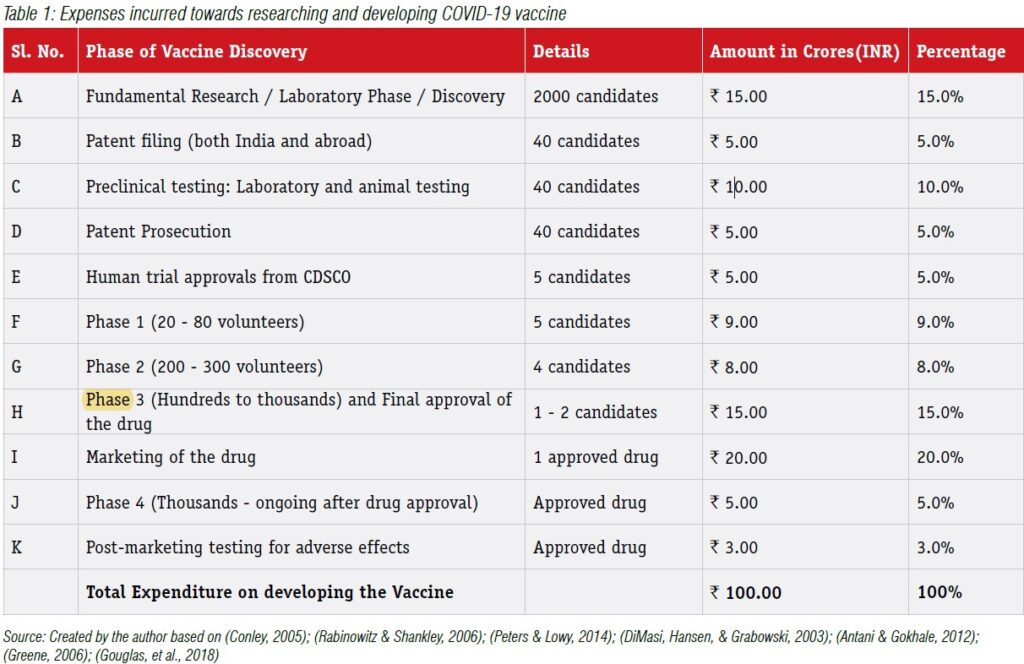

In order to understand how this issue pans out, let us take a hypothetical case where a pharmaceutical company expends around Rs.100crores on R&D to find a vaccine that is effective against the COVID-19 virus. It could be expending this Rs.100crores as highlighted in Table 1.

Under the cost approach of valuing intellectual property assets (IP Asset), one can adopt three kinds of costs: the original cost approach, the book cost approach and the replacement cost approach. Under the original cost approach, one considers the original cost to acquire or create a particular IP asset; under the book cost approach, only the costs the firm has actually incurred would be considered to arrive at the value of the IP asset; and under the replacement cost approach, the cost to be incurred by the firm to replace an IP asset with a new one would be considered as its value.

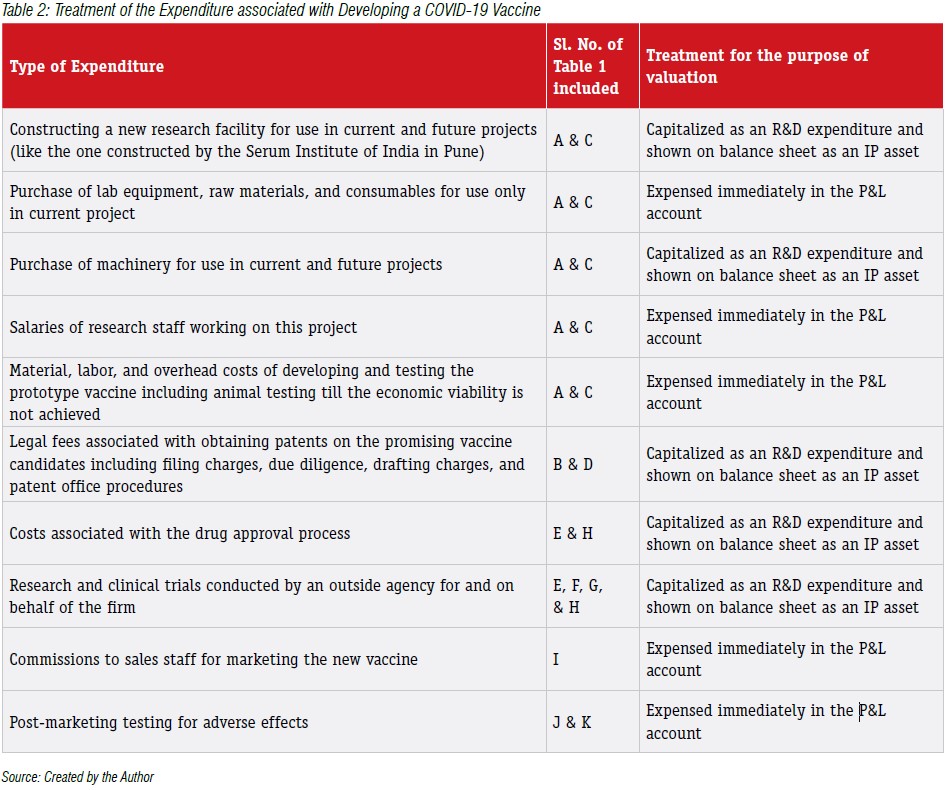

In our current case, the firm has spent around Rs.100Crores in creating the vaccine for COVID-19. Generally, any amount spent towards only research activities (also called fundamental research) would not be counted for valuing the IP asset and would have to be expensed in the year it has been incurred. This is because, the fundamental / exploratory research could be considered as investigating for gaining new scientific or technical knowledge on a particular phenomenon and may not lead to any specific future benefits to the firm. However, the costs associated with the application of research findings to plan or design for the production of new or substantially improved product or process before the start of commercial production process or use can be capitalized and be treated as an asset on the balance sheet of the firm. Based on these criteria, let us explore some of the important expenses that could be associated with developing a COVID-19 vaccine and its treatment for valuing the IP asset in Table 2.

As evident from Tables 1 & 2, very few items can be capitalized as an IP asset and shown on the balance sheet of the innovating firm. This is because, the valuation of IP assets is actually based on the quantum of future benefits that the expenditure would provide for the firm. If the expenditure does not provide any possible future benefits, then such expenses have to be expensed in the P&L account. However, if the expenditure is expected to provide sustained benefits over a long period, then it can be capitalized and shown on the balance sheet of the firm. Based on this reasoning, we can notice that despite the firm spending around Rs.100crores, under the cost-based approach, the value of the IP asset represented on the balance sheet would be around Rs.57Crores (assuming Rs.10Crores of A & C is eligible to be capitalized). The remaining expenditure spent towards R&D expenditure for COVID-19 vaccine would be treated as revenue expenditure and expensed in the current year P&L account.

However, if the pharmaceutical and biotechnology firm acquires another company carrying out R&D activities on the COVID-19 vaccination and has acquired certain patents and has progressed considerably in the drug approval process, then not only the Rs.100Crores spent on acquiring such a company, but any additional funds paid towards goodwill of the firm can also be capitalized by the firm and integrated in its existing balance sheet, thereby augmenting the size of its balance sheet.

Though the accounting principles, specifically the principles of conservatism and prudence play a significant role in this process, it presents a significant policy concern that needs to be addressed by the Government. If firms were unable to capitalize their expenditure towards R&D, then they would be unwilling to invest towards the discovery of such crucial elements essential for maintaining the public health and safety of its citizens. If the government expects these firms to rise up to the demands of the government, then it has to incentivize them in some manner to motivate them to be investing in R&D activities. The research grants provided by the governments to pharmaceutical and biotechnology companies in some developed countries could be one such alternative.

Conley, J. G. (2005). AstraZeneca, Prilosec, Nexium: Marketing Challenges in the launch of a Second-Generation Drug. Chicago: Kellogg School of Management.

Rabinowitz, M. H., & Shankley, N. (2006). The Impact of Combinatorial Chemistry on Drug Discovery. In C. G. Smith, & J. T. O’Donnell, The Process of New Drug Discovery and Development (pp. 55-78). New York: Informa Healthcare.

Peters, S., & Lowy, P. (2014, June 23). Cost to Develop and Win Marketing Approval for a New drug is $2.6 Billion. Retrieved October 1, 2016, from Tufts Center for the Study of Drug Development: http://csdd.tufts.edu/news/complete_story/ pr_tufts_csdd_2014_cost_study

DiMasi, J. A., Hansen, R. W., & Grabowski, H. G. (2003). The Price of Innovation: New Estimates of Drug Development Costs. Journal of Health Economics , 22 (2003), 151-185.

Antani, M., & Gokhale, G. (2012). Contract Research and Manufacturing Services (CRAMS) in India: The Business, Legal, Regulatory, and Tax Environment in the Pharmaceutical and Biotechnology Sectors. Cambridge, UK: Woodhead Publishing.

Greene, H. E. (2006). Funding the birth of a Drug: Lessons from the Sell Side. In C. G. Smith, & J. T. O’Donnell, The Process of New Drug Discovery and Development (pp. 585 – 602). New York, USA: Informa health.

Gouglas, D., Thanh Le, T., Henderson, K., Kaloudis, A., Danielsen, T., Hammersland, N. C., et al. (2018). Estimating the cost of Vaccine Development agaisnt epidemic infectious diseases: A Cost minimization study. The Lancet , 6 (December 2018), e1386 – e1396.

Dr. Nithyananda is currently working as a Faculty Member at the Indian Institute of Management Tiruchirappalli, Tamil Nadu, India, where he teaches electives like Strategic Management of Intellectual Property Rights, Business Models for Managing Intellectual Property Rights, and Legal Aspects of Marketing apart from the core course of Legal Aspects of Business. He earned his PhD in the area of intellectual property and its management from the National Law School of India University, Bangalore. He is also trained at the Harvard Business School on effective management teaching using business cases and business simulation. He has designed a simulation-based course “Strategic Management of Intellectual Property Rights”, which he has been teaching at various institutions and universities at France, Malaysia, Singapore, and Sri Lanka for the last 7-8 years. He has also trained working executives and management professionals on Managing Intellectual Property Assets, which is an area he is very passionate about.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved