or

On 20th February 2023, The Securities and Exchange Board of India (SEBI), released a consultation paper on ESG Disclosures, Ratings and Investing in order to ensure transparency and simplification in the evolving world.

ESG (Environmental, Social, and Governance) risks have indeed been gaining increased recognition in recent years. ESG factors refer to a set of criteria that are used to evaluate a company’s performance and impact in areas beyond just financial metrics. These factors include environmental sustainability, social responsibility, and corporate governance practices. As a response to this, SEBI, made it mandatory for the top 1000 listed companies (by market capitalization) to make ESG disclosures in the Business Responsibility and Sustainability Report (BRSR) from Financial Year (FY) 2022- 23 (https://www.mondaq.com/india/climate-change/1069266/importance-ofnew-business-responsibility–sustainablereporting-framework Refer to this article for a detailed analysis on importance of BRSR) and has also mandated the disclosures for ESG labelled mutual funds. Further, the regulator is also in the process of drafting a framework for ESG Rating Providers (ERPs).

With the growing recognition of ESG risks, SEBI felt the need to streamline the areas of ESG disclosure, ratings and investing. In this regard, the regulator has identified the need for assurance and expanding the scope in ESG disclosures, need for ESG Rating providers (ERP) to factor in the local/domestic context while providing ESG ratings and need to ensure robustness of disclosures and mitigate the potential risk of green washing and mis-selling under ESG investing.

SEBI constituted the ESG Advisory Committee (EAC), chaired by Shri. Navneet Munot MD & CEO HDFC AMC, to make recommendation regarding the same. This consultation paper lists down the recommendations and internal deliberations made by the EAC and seeks public comments on the same.

With BRSR becoming mandatory for the top 1000 companies (by market capitalization), EAC has identified 3 key areas that needs to be reviewed as part of this consultation paper. These three areas are as follows:

The proposal made for public consultation with regards to the issues identified above are as follows:

This document lists down select Key Performance Indicators (KPIs) for each E, S and G attributes and specifies the methodology for easy reporting and verification of data by an assurance provider. The BRSR core was prepared using certain approaches. These approach includes metrics in the KPIs that are reflective of sustainable outcomes in companies, containing factors that are relevant to both manufacturing and service sectors and in Indian context, and the KPIs containing intensity ratios to enable comparability irrespective of size of company.

The committee has decided to update the BRSR to incorporate the KPIs proposed in the BRSR core that are not present and to mandate the reasonable assurance of these KPIs in a gradual manner. (FY 22-23 Reasonable assurance not mandatory, FY 23-24 Reasonable assurance on BRSR Core mandatory for top 250 companies, FY 24-25 Reasonable assurance on BRSR Core mandatory for top 500 companies, FY 25-26 Reasonable assurance on BRSR Core mandatory for top 1000 companies)

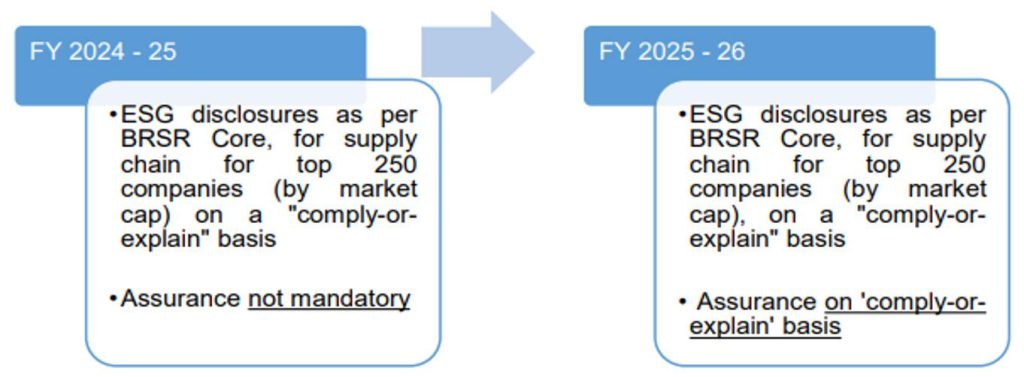

Keeping in mind that the supply chain partners may be small, unlisted firms and it may be difficult for such companies to track and report on a large number of ESG metrics, the committee has proposed to introduce a limited set of ESG disclosures (BRSR Core) for the supply chain partners. This will be made mandatory in a gradual manner. (FY 24-25 ESG Disclosures as per BRSR Core for supply chain for top 250 companies not mandatory, FY 25-26 ESG Disclosures as per BRSR Core for supply chain for top 250 companies on comply or explain basis mandatory)

Under Part 2, EAC has identified 2 key areas for review. These areas are as follows:

The proposal made for public consultation with regards to the issues identified above are as follows:

The said list was prepared keeping in mind that Indian companies align their processes as per Indian standards set by Perform, Achieve & Trade (PAT) scheme, Extended Producer Responsibility (ERP) scheme etc., Social realities in India vary and are very different from developed nations and that the governance structure should cover relevant areas such as related party transactions, Independent directors and the presence of a RegTech systems for monitoring compliance.

Under Part 3, EAC has identified 3 key areas for review. These areas are as follows:

The proposal made for public consultation with regards to the issues identified above are as follows:

Climate change and sustainable development concerns are two interconnected issues that have gained significant attention in recent years. They represent some of the most pressing challenges facing humanity and the planet, and they are closely linked to various environmental, social, and economic issues

ESG (Environmental, Social, and Governance) considerations have gained recognition and importance in India’s corporate landscape in recent years. The recognition of ESG factors in India is driven by several factors. First, there is an increasing awareness of environmental challenges, including air pollution, water scarcity, and climate change, which has prompted companies to incorporate sustainable practices into their operations. Second, social issues such as gender equality, labour rights, and community development have gained prominence, leading companies to focus on their social impact and stakeholder engagement. Lastly, good governance practices, transparency, and ethical conduct are being emphasized to improve corporate accountability and investor confidence. As a result, there has been a growing emphasis on ESG reporting and disclosures in India, with regulators, investors, and stakeholders advocating for more standardized and transparent ESG metrics.

Investors are relying heavily on the disclosures made by the companies and the ESG rating providers in their decision making. However, the EPRs not being regularized by any statutory framework, opens up the securities market to a potential risk. In order to mitigate the said risk, SEBI has formulated a regulatory framework for “ESG Rating Providers” or “ERPs” (https://www. sebi.gov.in/reports-and-statistics/ reports/feb-2023/consultation-paperon regulatory-framework-for-esgrating-providers-erps-in-securitiesmarket_68337.html ).

Sonal Verma leads the ESG Practice in the firm as a Partner and Global Leader – Markets & Strategy. With his crossroad working with business & laws – he brings advice & technology for effective change management in the journey of ESG. Sonal is well acclaimed for his work in regulatory & compliance programs over the last decade. He had in the past worked with 1800 plus clients in India and 61 other countries globally. He has worked with the top 3 unicorns and many Fortune 500 companies. His clients have been across different industries, viz. Automotive and OEMs, Pharma and Life Sciences, Manufacturing, Chemical Industry, BFSI, Infrastructure and Utilities (including stateowned PSUs), e-Commerce and Fintech Companies, Diversified Conglomerates etc.

Anshita Agrawal is an Associate with the firm working in the ESG Domain. Her core expertise lies in compliance decoding of various legislations along with its respective regulations, researching on various legal frameworks and aspects related to ESG and Sustainability.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved