or

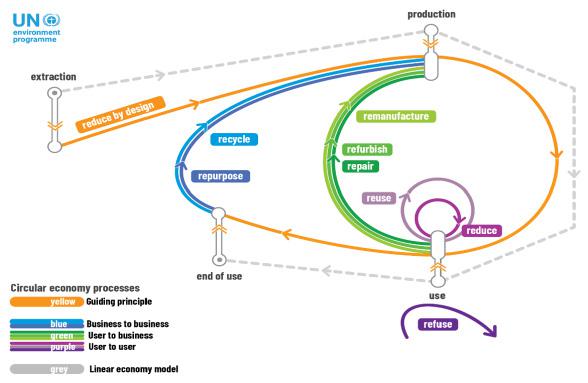

Circular economy relies on reuse and recycle of waste [Figure 1]. The same can be achieved in case of e-waste with its proper collection by authorized recyclers, recycling by trained professionals and implementation of an extensive Extended Producer Responsibility (EPR).

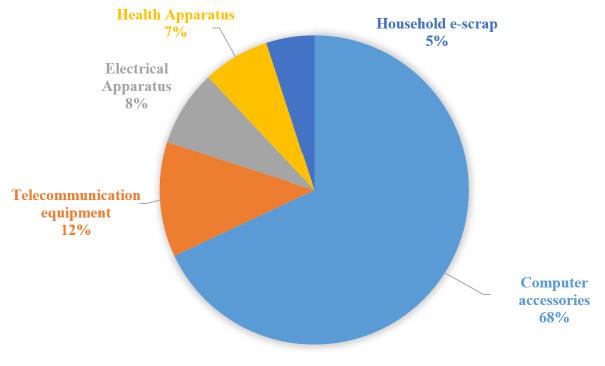

E-waste includes different kinds of electrical & electronic waste such as computer accessories, telecommunication equipment, electrical apparatus, health apparatus & household e-scrap [Figure 2]. The generation of huge amount of e-waste leads to the difficulty in recycling & management of this waste. E-waste may contain components made of iron, steel, plastic, copper, etc. and certain hazardous elements such as lead, cadmium, mercury, and chromium.2 It might also contain certain precious metals such as gold, silver or platinum. India is the third largest producer of e-waste after China and United States.

Recycling of e-waste serves two purposes simultaneously, first being the removal of this massive waste from the environment & secondly, recovery of the valuable materials from the waste. In India, most of the e-waste is recycled informally in a rudimentary manner, hence, end up in landfills and remain in the environment for a very long time. Recycling of e-waste by untrained professionals at ill-equipped facilities often lead to the generation of toxic substances such as POPs (Persistent Organic Pollutants) including PCB (Polychlorinated Biphenyls), PAH (Polyaromatic Hydrocarbons), PCDDs (Polychlorinated dibenzo-p-dioxins) etc. and other heavy metals.4 It also causes the loss of valuable materials which can otherwise be recovered, recycled & reused.

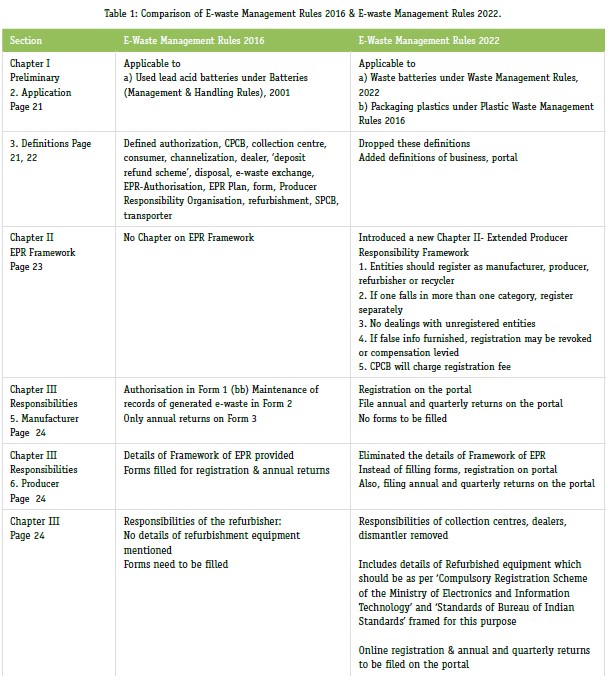

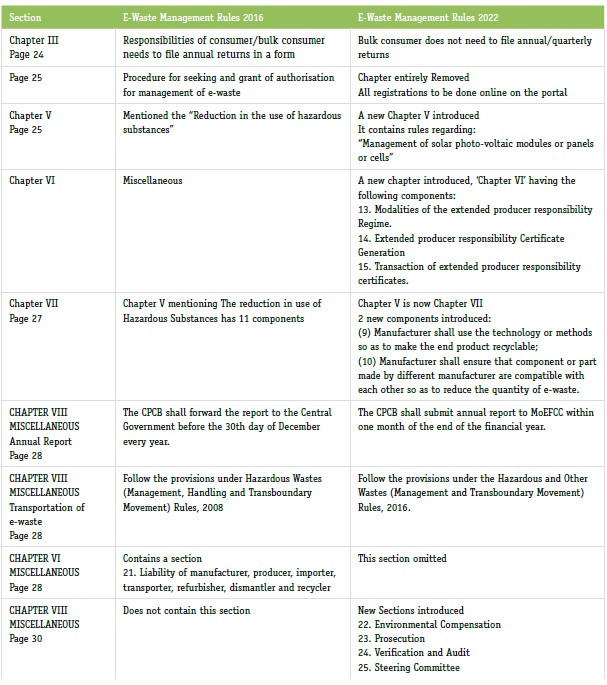

India generates around two million tons of e-waste every year which is increasing at an alarming rate. The Ministry of Environment, Forest & Climate Change (MOEFCC) replaced the E-waste (Management) Rules, 2016 by the E-waste (Management) Rules, 2022 in order to better manage this waste. The major highlight of the new rule is the introduction of recycling targets for the producers under the EPR (Extended Producer Responsibility) Plan. This document provides a detailed analysis of the comparison of the E-waste Rules of 2016 & 2022.6,7,8

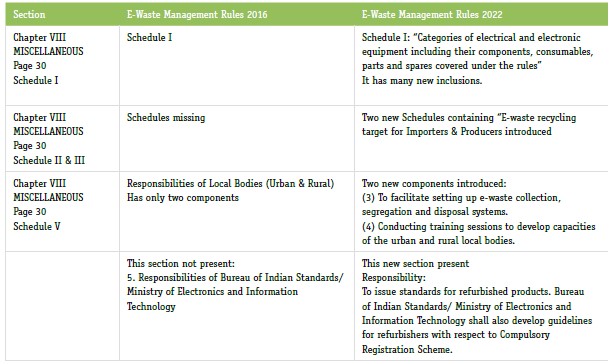

The major highlights of E-waste (Management) Rules 2022 includes [Table 1]:

The new regime from 1st April, 2023 surely is in the right direction of alignment with Basel Convention, Waste Electrical and Electronic Equipment (WEEE) Directive in the European Union & Restrictions of Hazardous Substances (RoHS) Directive.

The driver for e-waste regime is changing globally. E-waste regulations in most countries is a way to protect health and environment, and then moves to creating and securing employment by conserving our scarce resources in our countries in order to create new products out of it. India over scores higher than many western countries in its efficiency in e-waste with its repair sector & collection services.

This allows less dependency on other countries who are rich in minerals. Based on some industry studies, about 1.8 million tons of e-waste arising this year in India, can establish 300,000 jobs approximately in a new market sector of more than 3 billion US$ annually. In addition, many more jobs can be secured in the production sector because recycling precious and critical metals is the basis for manufacturing new products in India when resources are becoming scarce and more expensive. Thus, we call our high-tech wastes today an “urban mine”.

India has one of the fastest growing IT & Telecom industries in the world. Hence, humongous amount of e-waste is generated and in addition to that, India also imported e-waste from United States, China and in small quantities from other countries. Although, the imports have been controlled but still the e-waste generation is increasing every year at an alarming rate.

The major challenges in taking care of e-waste in India are lack of infrastructure, high cost of setting up recycling facilities, involvement of child labour in collection, segregation and distribution, ineffective legislation, lack of incentive schemes and also lack of awareness and sensitization on the issue.10 Another issue is the complex nature of the waste including base materials, precious elements and many other components. Every component of e-waste has a different recycling mechanism. Hence, an advanced facility with trained professionals is required for proper handling of this waste.11

For achieving benefits of the e-waste regulatory regime, the role of the informal sector needs to be nurtured as they are very important in collection, segregation & dismantling. They need to complement the formal recyclers as supply chain partners. We are ascertained that future evolution of the e-waste regime would have clearer vision on the same.

Sonal Verma leads the ESG Practice in the firm as a Partner and Global Leader – Markets & Strategy. With his crossroad working with business & laws – he brings advice & technology for effective change management in the journey of ESG. Sonal is well acclaimed for his work in regulatory & compliance programs over the last decade. He had in the past worked with 1800 plus clients in India and 61 other countries globally. He has worked with the top 3 unicorns and many Fortune 500 companies. His clients have been across different industries, viz. Automotive and OEMs, Pharma and Life Sciences, Manufacturing, Chemical Industry, BFSI, Infrastructure and Utilities (including stateowned PSUs), e-Commerce and Fintech Companies, Diversified Conglomerates etc.

Manjari Kumari is the Manager of ESG Practice in the firm who primarily works in the areas of ESG Advisory, Suatainability & Climate Change. She holds vast research experience in the field of Environmental Technology & Management and serves as the “Subject Matter Expert” for all Environment ralated cocerns of Clients.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved