or

Controversial yet an Essential Tribunal” this is how NCLT (National Company Law Tribunal) can be more essentially defined. NCLT had been engrossed with legal validity even before its inception. With Madras Bar Association challenging the constitutional validity of NCLT, intervention of the Hon’ble Supreme Court was sought for, wherein the Apex Court though holding the validity of NCLT refuted on provisions with respect to the qualification of the members of the Tribunal.

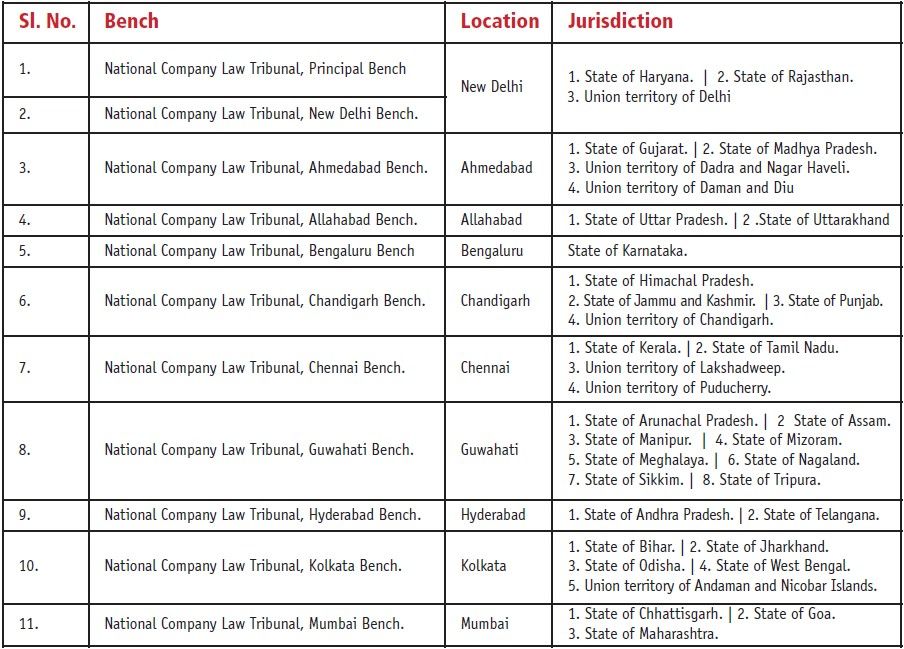

The Tribunal finally came into existence on the 1st day of June 2016. The Ministry of Corporate Affairs vide its notification constituted the NCLT, inline with the decision of the Apex Court with regard to the qualifications of the members. The principal office of the Tribunal being situated in New Delhi and the remaining 10 (ten) benches located in a manner catering and having jurisdiction over the length and breadth of the country. A snapshot of the jurisdiction of the NCLT benches is as follows:

The Companies Act 2013 had been framed with the objective of reducing corporate litigation, and keeping this vision it envisaged the establishment of a Tribunal, i.e. NCLT, dedicated to the handling of corporate litigations and disputes. Not only this The Insolvency and Bankruptcy Code, recently passed by the Parliament, also seeks to bring the insolvency issues within the ambit of NCLT.

Since the establishment of NCLT was pending for long, the application of Companies Act 2013 had been done phase wise and consequently the provisions dealing with NCLT/ Tribunal were not notified. The Ministry of Corporate Affairs along with notifying the establishment of NCLT also notified certain sections of the Companies Act. The notification seeks to devolve the working of the Company Law Board to NCLT.

Sec. 434 of the Companies Act 2013, which has been notified, is a transitional provision. Sub Section 1(a) provides for transfer of all matters pending before the Company Law Board to NCLT. Subsection 1(b) provides for appellate remedy, which states that an appeal from the order of Company Law Board can be made to the concerned High Court within sixty days form the communication of the order. As far as transfer of proceedings to NCLT is concerned it will be as good as initiation of a fresh case as because the matter needs to be deliberated again to the members for proper evaluation. Though the establishment and transfer of the proceedings is a welcoming step it tantamount to dilatory pronouncements of decisions in certain critical and complex ongoing matters

Though the transition being carried out replaces the Company Law Board with NCLT, it does not transpire to effective application of the provisions of the Companies Act. Even after the establishment of NCLT, there remains a cloud of ambiguity and confusion regarding the pending actions initiated, and the future action to be initiated.

The provisions notified as well as certain provisions of the Companies Act provides for making an application to NCLT for effective remedy. These provisions amongst others includes alteration of articles, conversion of type of company, compounding of offences, class actions suits, compromise or arrangements, mergers and de-merges etc. Out of these provisions certain provisions such compromise and arrangement, mergers and demergers have still not been notified, and as such the appropriate jurisdiction in this aspect still remains with the High Courts.

In respect of other provisions which talks about making an application or approaching the NCLT for remedy, they could not be given effect to until and unless the corresponding rules in these respect has been made and notified. As a result even though NCLT has been established its effective utilization is absent. The rules governing the working of the NCLT would be notified soon and perhaps after its notification NCLT might be reaching its optimum utilization.

Ankur Singhi [B.Com(Hons.), ACA, CS] is a practicing Chartered Accountant by profession, and a qualified Company Secretary.He is associated with S. K. Singhi & Co., Advocates as a Senior Associate for his advisory and consultancy services. He has substantial experience in the field of Corporate Advisory and Documentation. His core area of expertise involves transactional advisory, and advising on accounting and taxation issues to Foreign Nationals and NRI amongst others.Mr. Singhi is an associate member of The Institute of Chartered Accountants of India (ICAI).

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved