or

Since the economy has liberalized, the need and scope for investment in infrastructure sector has increased. India needs large investments which can only come through foreign investments. The government has already announced many measures to attract foreign investment in India. Read on to know more.

Infrastructure development is now the key to success for India. If India does not invest in infrastructure now, the benefits of opening up, which started in 1992, will be lost. Unless, India develops excellent infrastructure, its economy is not going to grow, because more private investments, particularly those from outside India, will be halted. Increasing trade and industrial growth are putting pressure on India’s poor roads, rail, ports, power, etc. They are creaking under the strain, preventing India’s economy from realising its true potential. Infrastructure sector is now going to be a key driver for the economy. The next big reforms are required in attracting investments in infrastructure development in India. India cannot develop infrastructure on its own, at a scale and pace required for its proper and timely development. India has to rely on private investment in infrastructure. The government has to explore all options to bring in more investments in infrastructure in India. The big-ticket investments can only come from deep pocket private investors outside India. So, the question is: does India have policies to attract big ticket foreign investments in infrastructure?

According to a report released by an Industry association, India needs ` 31 trillion to be spent on infrastructure development over the next five years, with 70 per cent of funds needed for power, roads and urban infrastructure segments. The Indian power sector needs US$ 250 billion in the next 45 years. The Indian construction equipment industry is expected to grow to US$ 5 billion by 2019-20 from current size of US$ 2.8 billion.

In June 2015, on the occasion of India Investment Summit in New Delhi, the erstwhile state finance minister, Jayant Sinha, while trying to woo foreign investors to invest in the ongoing infrastructure projects in India, told them that the project structure and regulations were being reviewed by the government to offer investors attractive returns. The RBI Deputy Governor H R Khan present at the summit also said that India was open for regulatory changes as situation demand nothing is cast in stone. “We are sensitive to (your) demand,” he said addressing the investors.

At the global level, foreign direct investments (FDI) is picking up. For the first time since the global meltdown in 2008, there was a jump in the foreign direct investment (FDI) at the global level in 2015.

This has been revealed in the World Investment Report released in June this year. But the report, which was released by Dr. Mukhisa Kituyi, Secretary-General of UNCTAD, has predicted an expected decline in 2016. It says that the FDI flows in 2016 are likely to contract by 10–15 per cent. Among the various reasons for the decline, the report has highlighted, are elevated geopolitical risks and regional tensions. But over the medium term, as the reports predicts, FDI flows are projected to resume growth in 2017 and to surpass US $1.8 trillion in 2018.

Foreign investment provides a channel through which countries can gain access to foreign capital. FDI is an investment that a parent company makes in a foreign country. In India, it is a direct investment into equity or convertible instruments of Indian companies. It comes directly through shares subscription or purchase and not through stock exchanges. FDI not only brings in capital but also helps in good governance practices and better management skills and even technology transfer. FDI is very important for any economy, as it is a long-term strategic investment, which comes with technical knowledge and expertise. It is not volatile investment and aims at increasing the enterprises capacity or productivity. In an FDI, the capital inflow is translated into additional production.

In a discussion on attracting investors, held at a summit organized by UNCTAD, the speakers highlighted that the key to attracting investors is stability and predictability. According to experts, in order to bring in more foreign investment the government should take measures like (i) working with tax authorities to bring down credit interest rates and create tax incentives; (ii) creating special economic zones and industrial parks; (iii) providing guarantees to investors (e.g., against expropriation); (iv) improving transparency, efficiency of administrative procedures; (v) and effective provision of information. The governments should be pro-active in attracting capital, e.g. by engaging into Public-Private Partnerships (PPPs), securing property and tenure rights to attract investors in agriculture etc. Several speakers reported that ICT adoption significantly improved business processes, e.g. by reducing business registration time.

India in recent years has announced many measures to boost foreign capital in India. In the consecutive budgets the measures have been announced which are aimed at attracting foreign investments in India. India has tried to bring ease in doing business by streamlining regulatory structures and investor friendly measures. It has also announced steps to re-vitalise PPPs. India is now more committed towards being a more predictable tax regime to further boost investor confidence and enhance FDI inflows. Recently, significant relaxations have also been announced in respect of the FDI policy including allowing foreign investment in insurance and pension sectors under the automatic route upto 49%. The government has introduced a step to reduce corporate tax to 25% over the four years. The government has reduced the long-term capital gains tax rate levied on the sale of shares of unlisted private companies to 10% from 20% for foreign investors. It has further reduced the holding period for an investment to qualify as long-term capital asset to 2 years from the earlier qualifying period of 3 years. Startups set up from 1 April 2016 up to 31 March 2019 and whose total turnover does not exceed INR 250 million (approximately US$ 3.7 million) are eligible for exemption equal to 100% of their income for 3 out of 5 years. As per the government’s word to the Supreme Court, MAT provisions will not apply to foreign companies who do not have a permanent establishment in India.

Taking a step towards dispute resolution and to bring more certainty, the government has made provision that a taxpayer can settle disputes at the first appeal level by paying tax and interest. In cases where disputed tax exceeds INR 1 million or more (approximately US$ 14,700), 25% of minimum penalty will also be payable. A one-time dispute resolution scheme for ongoing cases under retrospective amendments has also been provided by the government. The government has also committed itself to implementing GAAR from 1 April 2017.

The Dividend Distribution Tax for REITS and INVITS has been removed. The government has also allowed 100% FDI in Asset Reconstruction Companies (ARC) through the automatic route. In order to encourage investment in ARCs, complete pass through of income-tax to securitization trusts including trusts of ARCs has been proposed. The income will be taxed in the hands of the investors instead of the trust. However, the trust will be liable to deduct tax at source. It has also been proposed in the budget this year that an investment fund shall be eligible for a lower or nil deduction of TDS as per Double Taxation Avoidance Agreement. These collective efforts to reduce tax uncertainty will only compel international investors towards Indian opportunities across asset classes. In May this year, Finance Minister Arun Jaitley went on a six-day tour to Japan, to woo Japanese investors. He promised them more structural and market-oriented reforms as well as stepping up infrastructure spending to accelerate economic growth beyond the current 7.6 per cent. He also promised to reform the tax structure to make it simpler, predictable and stable. Jaitley said that a very large number of reforms have taken place over the last few years. “The objective has been to bring about structural reforms in India, and I think the consistency of that direction has helped in restoring the credibility of the Indian economy,” he said. He highlighted the second-generation reform measures undertaken by the government. Japanese conglomerate SoftBank has already made a lot of investment in India.

The government in December in 2015 set up the ` 40,000 crore National Investment and Infrastructure Fund (NIIF). While the government holding in the fund is 49%, the remaining would be held by private investors. NIIF is an investment vehicle for funding commercially viable greenfield, brownfield and stalled projects. Pitching for investment in NIIF, Finance Minister met global investors earlier this year while he was on his tour to Japan and promised them an “advantageous” tax regime in the country. NIIF has so far signed memorandums of understanding with Qatar Investment Authority (QIA), Russian firm RUSNANO and Abu Dhabi Investment Authority to explore investments, but there have been no formal announcements of financial commitments yet.

Indian aviation market is expected to become the third largest across the globe by 2020. Recently, Indian government announced a new aviation policy 2016, which is aimed at development of Greenfield airports and heliports, enhancing ease of doing business through deregulation, simplified procedures and e governance, promoting ‘Make In India’ in Civil Aviation Sector.

The present FDI policy on Airports permits 100 per cent FDI under automatic route in Greenfield Projects and in Brownfield Airport projects. For Scheduled Air Transport Service/ Domestic Scheduled Passenger Airline and regional Air Transport Services, it has now been decided to raise the limit to 100 per cent with FDI up to 49 per cent permitted under automatic route and FDI beyond 49 per cent through Government approval. For NRIs, 100% FDI will continue to be allowed under automatic route.

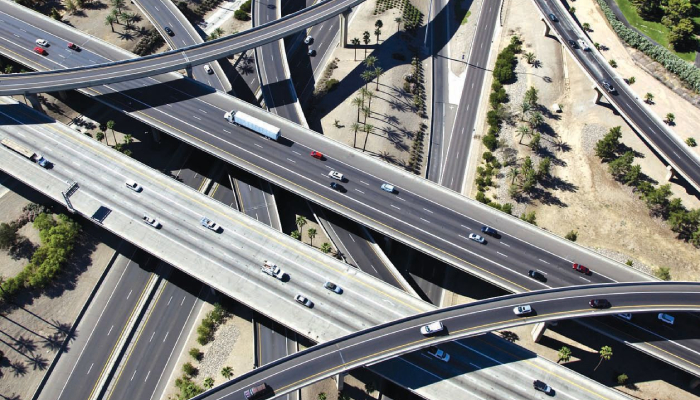

This sector accounts for over 90% of India’s PPP Infrastructure Project. Globally, India ranks second in roads network, spanning a total of 4.7 million kms. Recently, Mr Nitin Gadkari, Minister of Road Transport and Highways, and Shipping, has announced the government’s target of ` 25 trillion investment in infrastructure over a period of three years, which will include ` 8 trillion for developing 27 industrial clusters and an additional ` 5 trillion for road, railway and port connectivity projects. The minister went to the US for attracting investor in July this year. While trying to woo American firms for investing in India’s growing road infrastructure, the minister said that the Centre’s resolve to double the existing national highways network presents a ‘golden’ opportunity for the former from the point of view of economic viability and return on investment. The government aims at developing 50,000km of national highways by 2015 in 7 phases which has investment potential of about US $ 55 billion. The government has announced several incentives such as declaring the road sector as an industry, providing 100 per cent tax exemptions duty free imports of certain identified equipment for construction plants, FDI of up to 100 per cent and increased concession periods of up to 30 years.

India has the largest rail network in Asia and the second largest in the world. It covers a track-length of around 114,000 kms, running 12,500 trains to carry more than 20 million passengers daily. Additionally, it runs more than 7,400 freight trains carrying 3 million tonnes of freight every day. The sector allows for 100 per cent FDI under the automatic route. This includes construction, operation and maintenance of suburban corridor projects, high-speed train projects, dedicated freight lines, railway electrification and signalling systems, freight and passenger terminals and Mass Rapid Transit Systems (MRTS). FDI worth $12 billion have already been received. The major projects include Mumbai–Ahmedabad high-speed corridor project and CSTM–Panvel suburban corridor development project. The railway ministry has earmarked an investment of $133.5 billion toward development of the railways sector over the next 5 years ending 2019. Approximately 920 under and over-bridges construction to replace approximately 3,450 railway crossings at a cost of USD1 billion and about 400 railway stations (category A and A1) would be redeveloped or modernised in 2016-17 through PPP model expected , one of the largest PPP railway projects in the world.

To promote affordable housing projects and the building of smart cities, the government has allowed 100 per cent FDI in the construction sector. This move is expected to increase demand for cement, steel, fittings and fixtures, and create employment opportunities. According to new FDI policy, the minimum builtup area of 20,000 sq mtrs and minimum capital requirement of $5million are no longer necessary. Now each phase of a construction development project will be considered as a separate project for the purposes of FDI policy. The foreign investors will now be permitted to exit and repatriate foreign investment before the completion of a project under the automatic route provided that a lock-in period of 3 years has been completed. Further, foreign investors are permitted to exit on completion of the project or after development of trunk infrastructure, i.e. roads, water supply, street lighting, drainage and sewerage. Transfer of stake from one non-resident to another nonresident, without repatriation of investment, will not be subject to any lockin period and no Government approval will be required.

According a Financial Times report, in 2015, India replaced China as leading recipient of capital investment in Asia-Pacific with announced FDI of $63bn, as well making an 8% increase in project numbers to 697. Considering the need for infrastructure development for the growth of the economy, the Indian Government has allocated more funds to the sector and has tried to encourage foreign participation by bringing more structural reforms. It has announced a ` 40,000 National Investment and Infrastructure Fund to bridge the investment gap. Additionally, Indian government is reviewing the overall PPP policy to make changes in it in order to make the infrastructure sector investor friendly and easier to administer. The government has taken many measures to promote foreign direct investment in infrastructure in India. It has announced various measures to bring in ease in doing business and to make India the most advantageous tax jurisdiction. Because of these structural reforms and measures, coupled with administrative willingness, the confidence of the investors in India being a remunerative investment opportunity has increased.

The LW Bureau is a seasoned mix of legal correspondents, authors and analysts who bring together a very well researched set of articles for your mighty readership. These articles are not necessarily the views of the Bureau itself but prove to be thought provoking and lead to discussions amongst all of us. Have an interesting read through.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved