or

GST is a tax on goods and services with value addition at each stage having comprehensive and continuous chain of set-of benefits from the producer’s/service provider’s point up to the retailer’s level where only the final consumer would bear the tax. Goods and Service Tax (GST) is a multi-stage consumption tax imposed on a broad range of goods and services. It is levied on each transaction in the value chain but born ultimately by the end consumer who uses the goods or services.

The proposed model to be introduced in India is dual GST structure, the Central GST and the State GST which is compatible with Indian economic structure. There would be an additional Inter-state GST (IGST) which would be a combination of CGST and SGST and shall be imposed on all inter-state transactions of tax able good and services with appropriate provision for consignment of stock transfers of good and services.

The Proposed GST would integrate most of the existing indirect taxes currently levied by Central and state governments on tradable goods and services such as excise duty, service tax, state VAT/sales tax, countervailing custom duty, luxury tax and entertainment tax etc.

Globally most of the countries have a single taxation rate which is same forall goods and services across the country. Whereas in India, GST would be levied by both centre and state on the same tax base at pre-determined tax rates, at each stage of supply chain. Thus a tax payer will simultaneously pay central GST and State GST separately on transactions at each level of value addition.

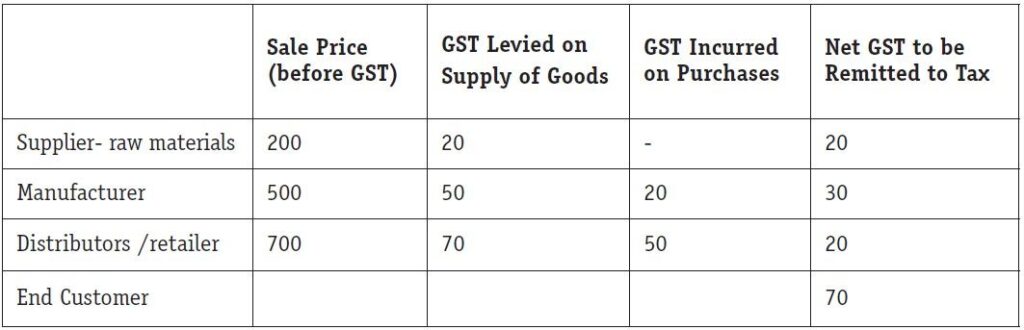

For example let’s assume ABC Company buys raw material and after manufacturing the products sells to the end user through distributors and retailers. Let us also assume the rate of GST to be 10% for the all the products manufactured.

The table below illustrates the flow of GST collected on value added cost in the process of supply chain:

From the above table, it can be noted that GST is collected on the value added at each level in the supply chain.

At the supplier level he charges and collects GST of ` 20 on his sale value of 200 from the manufacturer. The GST charge of ` 20 would be his output tax, as he does not incur any GST on his purchases. He is bound to pay ` 20 to Government of India.

As a manufacturer, he charges ` 50 for a sale on ` 500/- and the GST to be paid by the manufacturer to the government of India would be GST charged by the supplier minus the GST charged by the manufacturer which is ` 30/-

The same applies to the whole saler or retailer where as the end consumer pay ` 70/- on a purchase price of the product being ` 700.

The Indian Government has formed a technological SPV (Special purpose Vehicle) named GSTN (Goods and service tax network) for smooth implementation of the GST. The SPV is owned by the centre and the state and a strong technology partner the Mumbai based National Security Depository limited (NSDL).The technology portal would facilitate registration, returns, challans, interstate goods, refunds, audits and appeals on a click of mouse. NSDL has piloted the portal in 11 states to test the robustness and process performance and found it quite effective.

The existing tax structure has fragmented Indian market into 29 states markets thru tax barriers which discourages efficient production and supply chain model and restricts trade. Standalone multiple taxes have cascading effect on cost leading to competitive disadvantage to Indian industry.

Implementation of Comprehensive GST would be the ultimate finale of the fiscal reform process which was embarked upon a decade ago. Once implemented it will accelerate economic grown and take India to a commanding position in the world economy.

Jayashree Swaminathan is currently working as the Chief Executive Officer at UnComplycate. With over 30 years of a proven track record advising corporates on their governance, risk and compliance mandates, Jayashree has been eyeing at a visionary approach to create a 100% compliant India Inc. With compliance as per passion, she possessed added skills in terms of business acumen in form of improving the financial performance, operating efficiency, cost control, revenue enhancing initiatives, practical system improvements, business development enhancement capabilities, etc.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved