or

The last couple of years has witnessed an increasing demand among the investor community calling for high quality, transparent and accountable non-financial reporting by companies on including ESG (Environmental, Social and Governance) related matters. Post IFRS’s COP 26 Commitment in Glasgow in November 2021, the IFRS (International Financial Reporting Standard) Foundation Trustees announced the creation of ISSB (International Sustainability Standards Board), a reporting Board established to help develop a comprehensive global baseline of sustainability related standards. The primary objective of the ISSB has been to provide the investor community and other capital market participants with a robust framework that seeks information pertaining to an entity’s sustainability and climate related financial risks and opportunities. The continuous global push around ESG related reporting and disclosures, recovery from the cascading effect of the pandemic and the need for regulatory reforms at a global level spurred the urgency to design a dedicated standard focused on obtaining relevant information and disclosures on sustainability and climate related financial performance of an entity.

On 31st March 2022, the ISSB published two exposure drafts setting out proposed IFRS Sustainability Disclosure Standards (‘Exposure Drafts’)

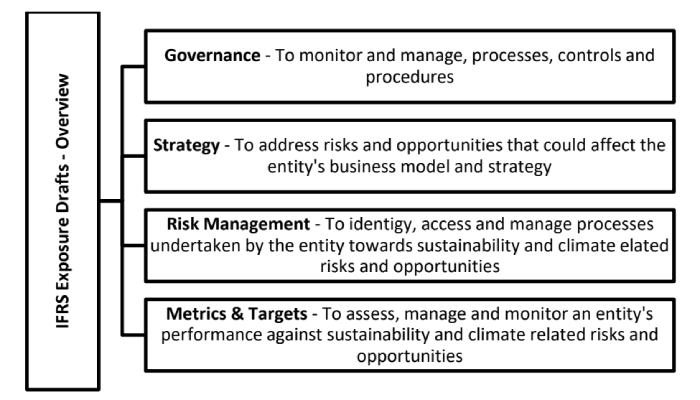

While the two exposure drafts are made available for public consultation till 29th July, 2022, the same are intended to provide a more streamlined approach to ESG-related disclosures at a global level across industries. The exposure drafts are accompanied by industry based disclosure requirements which are formulated in line with the TCFD (Taskforce on Climate-related Financial Disclosures) recommendations and tailored to industry classification derived from SASB (Sustainability Accounting Standards Board) framework. ISSB intends also to integrate other existing initiatives of CDSB (Climate Disclosure Standards Board), the Task Force for Climate-related Financial Disclosures (TCFD), the Value Reporting Foundation’s IR (Integrated Reporting) Framework and the World Economic Forum’s Stakeholder Capitalism Metrics. The provisions thereunder, seek information pertaining to certain sustainability and climate related topics & metrics which have been taken into account to map an entity’s efforts towards relevant disclosure requirements. The exposure drafts set out the overall requirements for entities to disclosure material information pertaining to significant risks and opportunities associated with sustainability and climate.

The information sought under the exposure drafts are designed to enable primary users to assess the enterprise value which also reflects the way an entity operates while capturing parameters like governance, strategy, management, etc. Furthermore, the draft seeks to derive information that is supported by interlinkages between sustainability-related disclosures and financial reporting. In order to align with the IFRS Sustainability Disclosure Standards, the reporting entity will be required to meet with all the requirements prescribed thereunder. An entity reporting against the parameters set out under the exposure drafts will be required to report its sustainability and climate related financial disclosures at the same time as its financial reporting.

The objective of this exposure draft is to require entities to disclose information pertaining to significant sustainability related risks and opportunities relevant to market players when assessing the enterprise value. A comprehensive sustainability related financial information as per the exposure draft shall include the governance structure of the entity and the strategy devised to address sustainability-related financial matters. It further seeks information on the entity’s performance and response undertaken in relation to the planet, people and the economy. An entity shall further be required to share a comparative of its progress from the previous year on related disclosure metrics. As part of the IFRS Climate related Disclosure Standard, an entity is required to provide industry-based information relating to significant climate-related risks and opportunities. The list of industries are as follows –

Super Industry Type*

The objective of this exposure draft is to access the level of impact that climate related risks and opportunities have on the entity’s value. It further requires information on the entity’s use of resources, activities that result in climate related risks and the strategy devised thereunder to manage such climate related risks and opportunities. The draft further enables evaluation of the entity’s ability to plan and manage its operations while aligning with climate related disclosures.

Clause 14 of this IFRS S2 draft holds significant importance to Climate related Financial Disclosures.

An entity shall disclose information that enables users of general-purpose financial reporting to understand the effects of significant climate-related risks and opportunities on its financial position, financial performance and cash flows for the reporting period, and the anticipated effects over the short, medium and long term—including how climate-related risks and opportunities are included in the entity’s financial planning. An entity shall disclose quantitative information unless it is unable to do so. If an entity is unable to provide quantitative information, it shall provide qualitative information. When providing quantitative information, an entity can disclose single amounts or a range. Specifically, an entity shall disclose:

Currently the Green Investments are mostly following the EU Taxonomy Rules which is fairly matured and the same gets coupled primarily with Financial Sustainability disclosures as per SASB, TCFD, IR and CDSB.

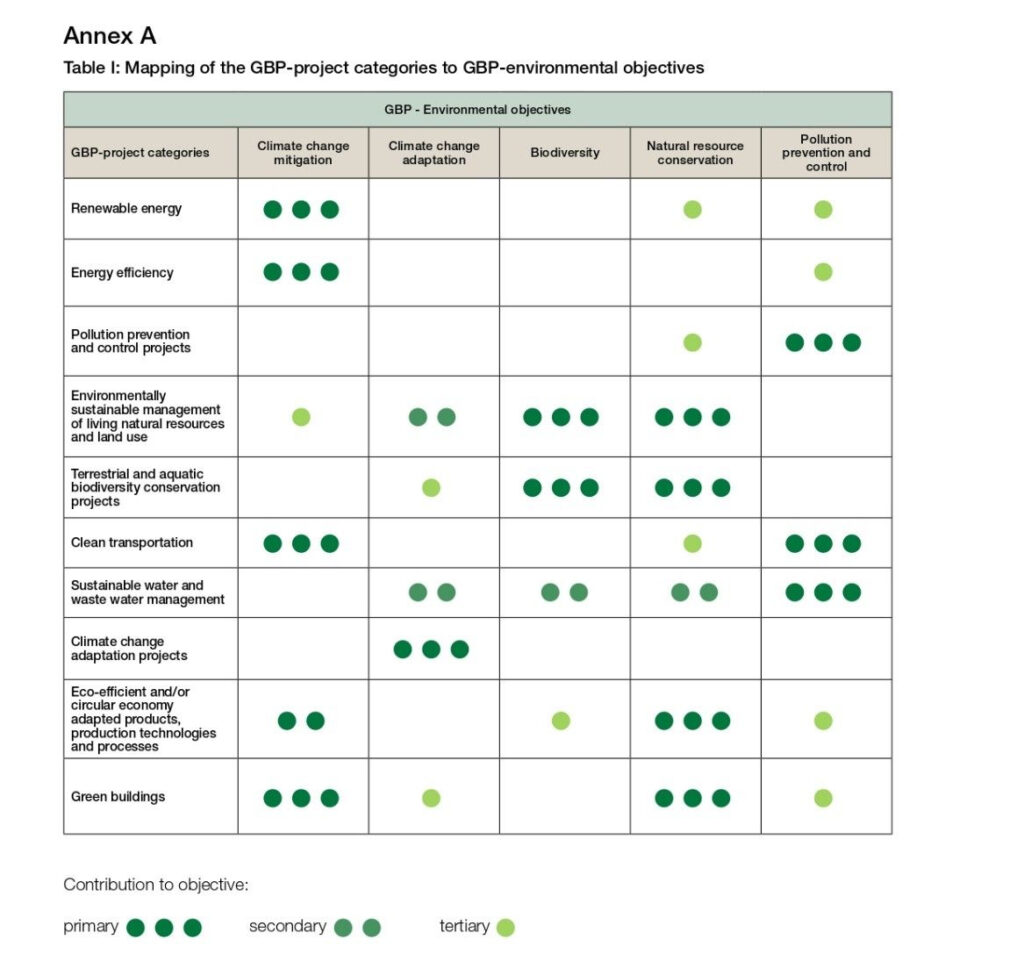

When market participants including issuers, investors, underwriters and other bond market participants are to determine whether or not a project may be considered as a green project, these participants may evaluate the classifications against one or more of the five high-level environmental objectives as set out under the EU Taxonomy Regulations –

The chart below gives a significant perspective of the green products in the financial Markets currently:

After due consideration of the two exposure drafts, it is evident that the information requirements are formulated to enable the assessment of an entity’s value based on its sustainability and climate related financial disclosures. The proposed drafts have been designed to support the information needs to the capital market players and the investor community. The purpose has been to take into account existing frameworks and accordingly provide a holistic approach, whereby the sustainability and climate related disclosures are standardized as a global baseline requirement. All comments and suggestions on the exposure drafts are to be made by 29th July, 2022, which will then be reviewed by the ISSB. With changes proposed by IFRS, soon the heterogeneity aspect in ESG impact measurement can be addressed significantly. We could see other accounting bodies like India’s ICAI also spring into action soon.

Tags: Dhir & Dhir Associates

Sonal Verma leads the ESG Practice in the firm as a Partner and Global Leader – Markets & Strategy. With his crossroad working with business & laws – he brings advice & technology for effective change management in the journey of ESG. Sonal is well acclaimed for his work in regulatory & compliance programs over the last decade. He had in the past worked with 1800 plus clients in India and 61 other countries globally. He has worked with the top 3 unicorns and many Fortune 500 companies. His clients have been across different industries, viz. Automotive and OEMs, Pharma and Life Sciences, Manufacturing, Chemical Industry, BFSI, Infrastructure and Utilities (including stateowned PSUs), e-Commerce and Fintech Companies, Diversified Conglomerates etc.

Fauzia Khan is an Associate at Dhir & Dhir Associates, working in the ESG domain. With the emerging change in the business landscape and awareness around sustainability, she contributes her expertise to help clients understand and adapt responsible and sustainable strategies with respect to compliance and ethics in the ESG realm.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved