or

Any organization dealing in business activities would broadly/roughly be called as a business enterprise. In order for a business enterprise to carry on business activities, it needs funds, which are typically provided by its owners in the form of owners’ equity. Such funds would be deployed in the business, by investing in various assets, which would then be utilized towards carrying out business activities. The revenue that is generated from such business activities would be used to calculate the valuation of the business.

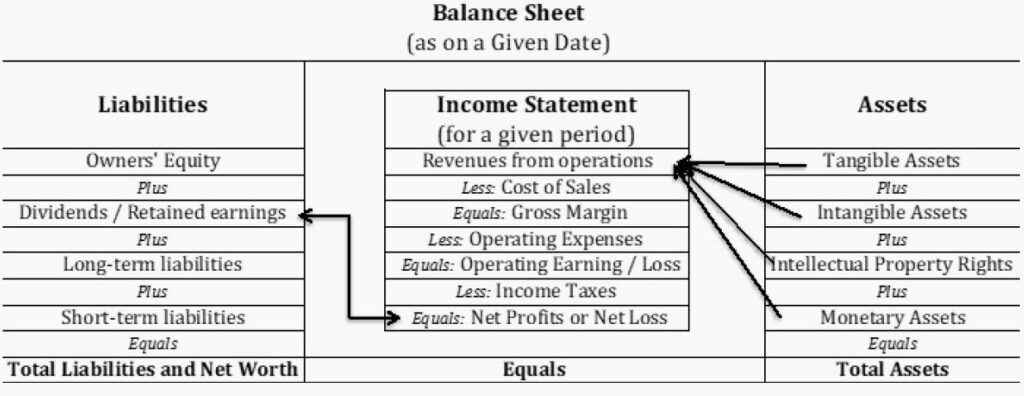

Before we understand how this operates, we need to understand financial statements of a business organization, viz., balance sheet and the income statement. Balance sheet is a positional document presenting the status of assets and liabilities of the business on a particular date, while the income statement is the summary of the operations (business activities) of the business over a period of time, presenting incomes, expenditures, and the final status of carrying out such operations. There are many formats that are in use to present the balance sheet and the income statement, including the ones mandated by the statute. For the sake of understanding, we would be using the horizontal model for the balance sheet, and the vertical model for the income statement, which are intuitive in understanding.

Let us take a hypothetical example to explore how the two statements interact with each other.

| Liabilities | Assets | |

|---|---|---|

| Owners’ Equity | = | Cash / Bank Balance |

Figure 1: A simplified Balance Sheet format

| Liabilities | Assets | |

|---|---|---|

| Owners’ Equity | Tangible Assets | |

| Plus | ||

| Plus | Intangible Assets | |

| Plus | ||

| Long-term liabilities | Intellectual Property Rights | |

| Plus | Plus | |

| Short-term liabilities | Monetary Assets | |

| Equals | Equals | |

| Total Liabilities and Net Worth | = | Total Assets |

Figure 2: A simplified balance sheet with all the components of the balance sheet

As shown in figure 2, generally speaking the assets must equal to the total of the liabilities. This is because, the financial resources that have been raised through owners’ equity and the borrowings can only be invested towards various assets that can be owned by the business.

While these assets contribute to the revenues of the business enterprise, the liabilities contribute to the costs associated with running the business organization. For instance, the bank loans have an interest obligation that needs to be paid to the bank, the debentures & corporate bonds have coupon interest rate to be paid to the investors; financial leasing would have leasing charges payable to the lessor; overdrafts and trade credit has interest charges to the organization, which would all contribute to the cost of sale of the goods and services finalized by the business organization.

The surplus of revenues over the cost of sales would be gross profit (if the cost of sales exceeds revenues, then it would be gross loss), from which operating expenses (in the nature of administrative and marketing expenses) would be deducted, resulting in operating profits or operating losses. From these operating profits / losses, incomes taxes would be deducted (only if there are operating profits), and the balance would be net profit or net loss.

net profit / net loss typically belongs to the shareholders of the business. The net profit is distributed to the shareholders in the form of dividends or retained in the business as retained earnings, which could be used for future growth of the business. However, the net loss reduces the owners’ equity (technically by wiping out their equity to the extent of the losses) or it could also reduce the balance of the retained earnings.

A summary of these transactions is presented in a statement called as “Income Statement”, which is presented for a certain period of time, usually one quarter or a half-year or one full financial year. A summary of these transactions is presented in the combined balance sheet and abridged income statement in Figure 3 below. The income statement is inserted between the asset side and the liabilities side of the balance sheet, just to make things simple to understand the relationship between various items in the balance sheet and the income statement.

Figure 3: A combined balance sheet and an abridged income statement of the business enterprise with inter-linkages of various items thereof.

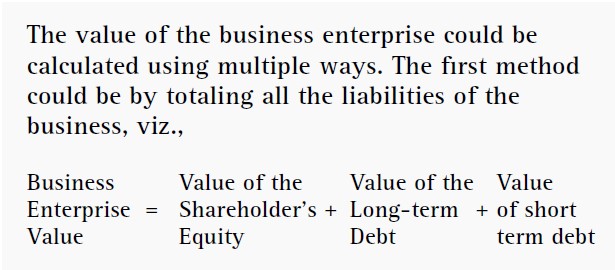

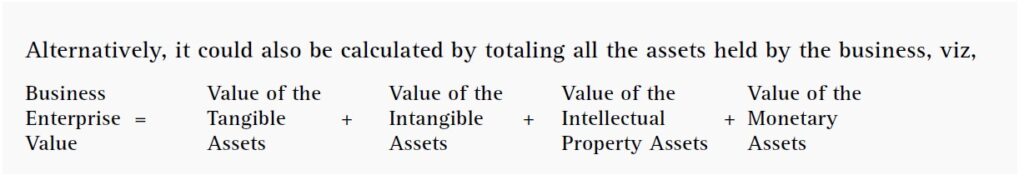

In the second technique of calculating the value of the business enterprise using the assets of the business, it is important to remember that the cashflows from each of these assets should be identifiable. Such identification helps to ascertain the value of each of these assets independently, which would come in handy while ascertaining the valuation of the business enterprise.

However, it should be remembered that while determining the value of each of these assets independently, one would also be able to calculate the valuation of these assets independently. For instance, if one were required to calculate the value of intellectual property assets, they would easily be able to calculate it based on the revenue earning capabilities of such IP assets. In the next episode, we shall explore the various techniques used in valuing intellectual property rights.

Dr. Nithyananda is currently working as a Faculty Member at the Indian Institute of Management Tiruchirappalli, Tamil Nadu, India, where he teaches electives like Strategic Management of Intellectual Property Rights, Business Models for Managing Intellectual Property Rights, and Legal Aspects of Marketing apart from the core course of Legal Aspects of Business. He earned his PhD in the area of intellectual property and its management from the National Law School of India University, Bangalore. He is also trained at the Harvard Business School on effective management teaching using business cases and business simulation. He has designed a simulation-based course “Strategic Management of Intellectual Property Rights”, which he has been teaching at various institutions and universities at France, Malaysia, Singapore, and Sri Lanka for the last 7-8 years. He has also trained working executives and management professionals on Managing Intellectual Property Assets, which is an area he is very passionate about.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved