or

Dematerialized Securities (‘Demat’ in short) are securities that are not on paper and a certificate to that effect do not exist. They exist in the form of entries in the book of depositories. Essentially, unlike the traditional method of possessing a share certificate to the effect of ownership of shares, in the demat system, the shares are held in a dematerialized form. This system works through a depository who is registered with the Securities and Exchange Board of India (SEBI) to perform the functions of a depository as regulated by SEBI. Under Section 68 B of the Companies Act, inserted by the Companies (Amendment) Act, 2000, it is mandated that every Initial Public Offer (IPO) made by a listed company in the excess of ` 10 Crores has to be issued in dematerialized form by complying with the requisite provisions of the Depositories Act, 1996.

Are you still holding shares of listed entities in physical form? The new regulations become applicable to all other investors, i.e. on 8 June 2018, market regulator SEBI issued a notification that transfer of securities will not be permitted unless they are de-materialized and the deadline for the same is December 5, 2018. The amendment shall come into force on the 180th day from the date of its publication in the Official Gazette, i.e., on December 5, 2018.

Moreover, prior to the amendment, both Listing Regulations and SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 required the entire shareholding of promoter (s) and promoter group to be in dematerialized form. However, the same was not required for public shareholders.

The amendment though is an outcome of the SEBI meeting held on March 28, 2018 but the plan was being thought of long back since 2014 and as per the broader sense it would be a good transition for the market. In our opinion, the transition will be smooth; the only hurdle will be in the case of companies that no longer function or have no trading activity. If yes, then you have time up to December to convert them into dematerialised form, without which you can neither transfer nor sell them.

In June 2011, the market regulator had mandated promoters of listed companies to convert their entire equity holding in dematerialised form by September 2011. SEBI had then said that failure to comply with compulsory dematerialisation of the promoter holding would invite punitive action.

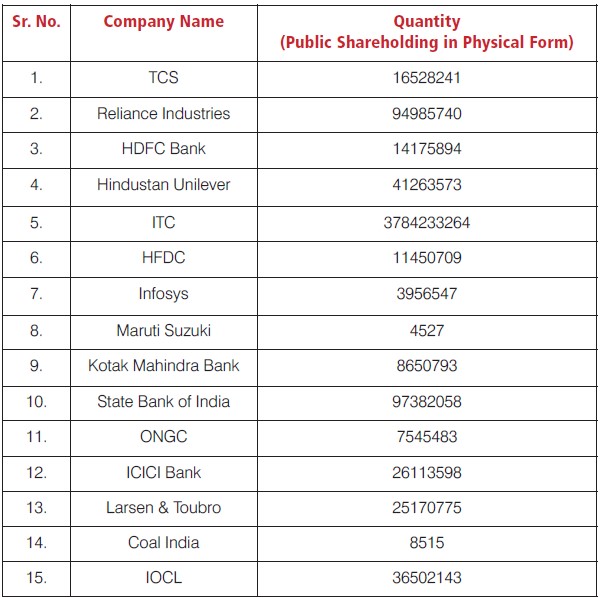

Some long-term retail and institutional investors still hold a sizable part of their stake in physical form worth ` 1.70 Lakh crore even seven years after the market regulator ordered 100 per cent dematerialisation of shareholding. The below mentioned table gives the rough number of shares which are still in physical form:

It is pertinent to note that there are several security holders who hold/ prefer to hold their securities in physical form and who are not in favour of holding their securities in electronic mode. The amendment will deprive the securities holder of their fundamental right of holding their securities in their desired form.

This is another instance of reactive law making. Several listed companies such as TCS, Aptech, Britannia Industries and Asian Paints had earlier filed a complaint against share transfer agent Sharepro for diversion of unclaimed dividends and shares of investors.

Though the amendment seems to curb the option of holding of the shareholders, the same on the other hand will help to digitalize the holdings of the shareholders, which will not only help in preventing fraudulent transfers but will also reduce compliance burden on the companies.

Though the amendment claims to improve ease, convenience and safety of transactions for investors, the same shall also bring various difficulties to the securities holder for whom the electronic system and the demat form does not seem to be user friendly. The bonafide securities holder, holding shares in physical form, will be largely affected by such compulsion and will be left with only two options i.e., either to convert their securities in demat form, which shall be against their will or to refrain from transferring their securities ever, in both the circumstances, it is the interest of the securities holder which shall get supressed by the law makers.

Rani Gupta is currently working with Wockhardt Ltd as Assistant Manager and has an experience of about 3 and a half years. She has completed her Company Secretary Course and LLB. Her area of interest is Corporate Law

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved