or

The Companies Act 2013was the highlyanticipated reform inthe corporatelegislation. The Actconsists of 470 sectionsand 7 Schedules. It looked much shorterand precise than its predecessor, whichcomprised of 658 Sections and 15Schedules. Though the Act was short andprecise, the execution of majority of itssections was done through the rulesframed under it. As a result there are 22rules complementing the Act, whichactually brought the Act into existenceand made it workable. Theimplementation of The Act was done intwo phases. Firstly on the 12th ofSeptember 2013, 282 sections and certainrules were enforced and the remainingsections and the rules were enforced from1st of April 2014.

There were certain ambiguous andvague provisions in the Act, which hadvaried interpretations, and rules thatcomplemented the Act to some extentamended the Act. These led tooperational difficulty and along with itthe Ministry of Corporate Affairs (MCA)issued and came out with variousnotifications and clarifications forinterpreting the same, such as theapplicability of Sec 185 and 186 in respect ofloans and advances to employees, CSR andSec. 135, Consolidated financial Statements,Related Party Transactions to name a few.

The Government received variousrepresentations from its stakeholdersregarding difficulty in practicalimplementation of the Act and having regardto the fact that

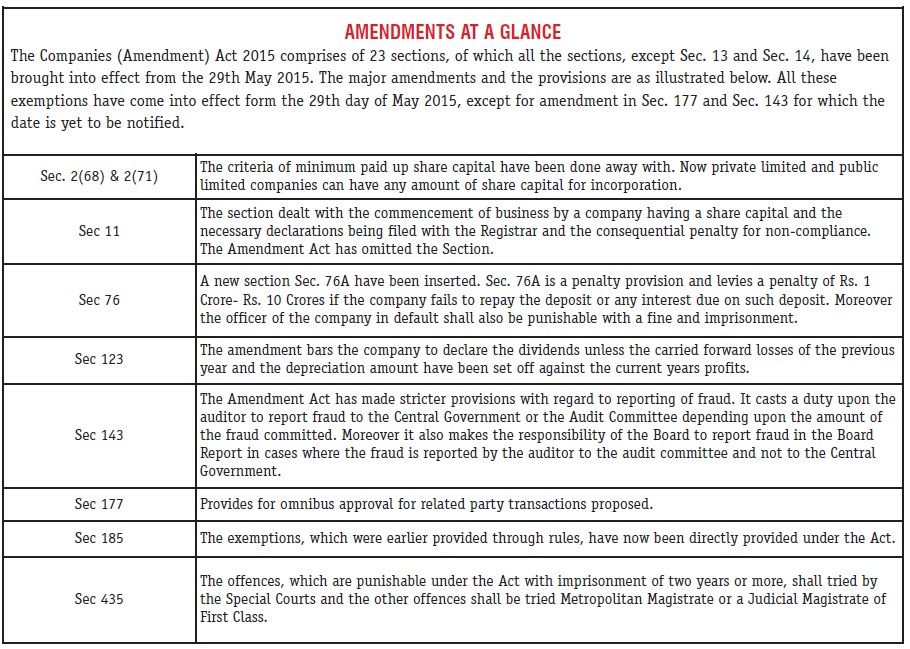

The amendment seeks at removing theambiguity in the act and provides for ease incarrying out the business and aims atrestoring investor confidence. The basic urgefor the amendment arose due to inability inpractical implementation of the CompaniesAct and the subsequent notices, circulars andclarifications issued by the Ministry ofCorporate Affairs. However, there are stillvarious areas, which are still ambiguous, andon which clarity and improvements can bedone.

Recently on the 5th of June, the Ministry ofCorporate Affairs has issued a notificationunder Sec 462 of The Companies Act 2013,wherein it has given relief and providedexemptions to the Private Limited Companies,Sec 8 Companies, Nidhi Companies andGovernment Companies from variousprovisions and sections of the Companies Act.These notable sections include amongst othersinclude Sec. 62, Sec. 67, Sec. 177, Sec. 185,Sec. 188 and many more.

Seeing the notifications it is quite evidentthat there is still scope for furtheramendments, improvements and clarity on theapplicability of the Companies Act so that itcan be implemented in a better manner. Ifthis prevails then the Ministry, from time totime, will have to come out withclarifications, notifications and circulars forimplementing the Companies Act.Simultaneously care should also be taken toensure that the harsh and severe penalty anddifficulty in the practical applicability doesnot hinder the ease and prospect ofconducting business.

S. K. Singhi, (B.Com[Hons.], ACS, LLb) Advocate is the founder/ proprietor of M/s S.K.Singhi & Co., Advocates, Kolkata, a full service young law firm established in November 2009. He is on the panel of Arbitrators of ICA, FICCI, BCCI. He is involved in various domestic and international arbitration proceedings. Besides representing his client in the arbitration proceedings, Mr. Singhi is conducting various arbitrations as Sole Arbitrator. Mr. Singhi prior to getting enrolled as an Advocate and starting his own law firm, was a practicing Company Secretary for nearly five years.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved