or

The Insolvency and Bankruptcy Code being one of the most extensive insolvency reforms was brought forward by the parliament in November 2016. The Insolvency and Bankruptcy Code has been introduced in order to bring uniformity to the country’s scattered bankruptcy laws. The objective of this Code is to simplify the process of Insolvency and Bankruptcy proceedings in the country which shall aid the creditors along with the stakeholders and resolve the issue of bad debts and the significant increase in the nonperforming assets of the banks and to curb the delay in debt resolution. In the case of Swiss Ribbons Vs Union of India1 , the Hon’ble Supreme Court has held that the main object of the Code is to ensure the revival and continuation of the corporate debtor. Hon’ble Justice R.F. Nariman in Swiss Ribbons Vs Union of India observed that “The defaulter’s paradise is lost. In its place, the economy’s rightful position has been regained.” Thus, the Code has a larger public-welfare consideration in play.

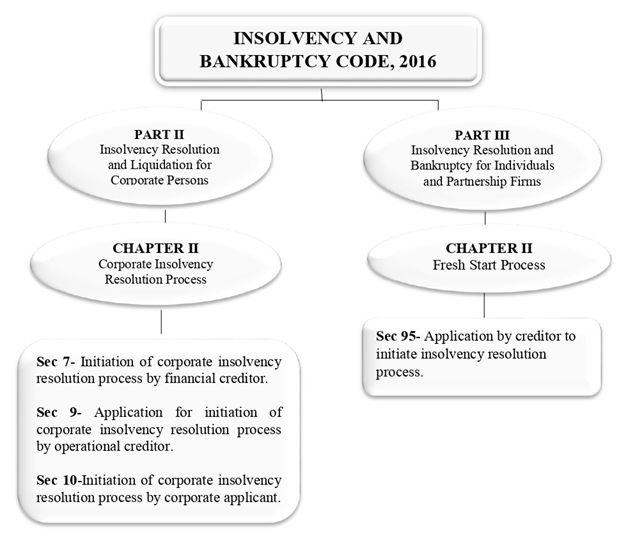

Insolvency procedure can be initiated by 3 different entities:

The present article intends to delve into the aspect of contrast between the insolvency proceedings initiated against a Company and an Individual (both termed as Corporate Debtor).

It has been laid down under Section 6 of the Code that in cases where a Corporate Debtor commits a default, a Financial Creditor, an Operational Creditor, or the Corporate Applicant (including the Corporate Debtor) itself, may initiate CIRP for the Corporate Debtor, in the manner detailed under Chapter II of Part II of the Code. Hence, the trigger for initiating the CIRP is the default by the Corporate Debtor.

Sections 7, 9 and 10 of the Code are envisaged under Chapter II, Part II of the Code. Through Section 7 of the Code, the Financial Creditor of a company can initiate the insolvency resolution process, through Section 9 of the Code, the Operational Creditor of a company can initiate the insolvency resolution process and through Section 10 of the Code, a member or partner of a company can initiate the insolvency resolution process and file an application before Hon’ble NCLT for adjudication. Upon admission of such Application, Corporate Insolvency Resolution Process (CIRP) shall be initiated against the Company.

On the other hand, Part III of the Code provides for matters relating to the fresh start, insolvency, and bankruptcy of individuals and partnership firms. Initially, only those provisions of the Code that dealt with insolvency and liquidation process of corporate persons were made applicable. By way of a notification dated November 15, 2019, the Central Government had declared that certain provisions of the Code, only in so far as they relate to personal guarantors to Corporate Debtors, would come into force on December 1, 2019.

Pursuant to the enforcement of part III of IBC to personal guarantors, various insolvency proceedings were initiated by banks and financial institutions against the personal guarantors of the corporate debtors. As on September 30, 2022. Interestingly, the vires and the validity of the notification dated 15.11.2019 was challenged in various proceedings preferred under Article 32 of the Constitution of India and was upheld by the Hon’ble Supreme Court of India in Lalit Kumar Jain vs Union of India2 .

Since enforcement of Part III of the Code, several creditors initiated the insolvency proceedings against both the corporate debtor and the personal guarantors. The Supreme Court in Lalit Kumar Jain held that simultaneous proceedings are valid against both corporate debtor and personal guarantor with the caveat that the creditors cannot recover amount more than that of the total amount claimed. The Debtor, under section 94, and the creditor under section 95 of the Code, may apply to the Hon’ble Adjudicating Authority to initiate the insolvency resolution process against a Guarantor or a Director or a Partner of a Company. On filing of the application, an interim moratorium under section 96 of the Code sets in

Proceedings against personal guarantors find their origin in Section 128 of the Contract Act, 1872 which deals with the co-extensive liability of a surety. It has long been considered that a surety’s liability to pay the debt is not removed by reason of the creditor’s omission to sue the principal debtor. Such a creditor is not bound to exhaust his remedy against the principal debtor before suing the surety, and a suit may be maintained against the surety even though the principal debtor has not been sued.

Section 60 of the Code contemplates the instances in which Insolvency Resolution Process can be initiated against the personal guarantors of the corporate debtor. While the scope of Part I of the Code is to resolve the corporate debtor and ensure it is kept as a going concern, the scope of Part III of the Code is to ensure that the personal guarantors of the corporate debtor do not obfuscate their obligations. Section 60 dictates the jurisdiction of Hon’ble NCLT to adjudicate Applications filed under Section 95 of the Code.

The Code as a legislation is comparatively at a nascent stage. However, it is interesting and commendable to note the manner in which the Tribunals are giving teeth to the provisions of the Code. Increasing efforts are being made to interpret the sections keeping in mind the commercial steps and transactions undertaken by entities in this day and age. The Tribunals have been mindful to strike the right kind of balance to ensure that the personal guarantors of the corporate debtors are not allowed to elude their obligations to their creditors.

In the year 2001, right to compete was also established in this industrialized corporate country, but the main problem was the right to exit from this corporate economy was not provided easily, with the introduction of Insolvency and Bankruptcy Code in the year 2016 it was easier for any corporate personality to liquidate and close down their body.

In line with the intent of the legislators, the Tribunals, with every passing judgment have been evaluating in what circumstances applications filed against Personal Guarantors under Part III of the Code must be entertained. By virtue of the orders passed by the Hon’ble Supreme Court and Ld. National Company Law Appellate Tribunal (NCLAT) in State Bank of India Vs Manoj Kumar Jajodia3 , it is now settled law that applications filed under Section 95 against the Personal Guarantors are also maintainable in the absence of pending CIRP or liquidation proceedings of the Corporate Debtor.

Ashu Kansal is a Partner at Adhita Advisors, having more than fifteen years of experience. His main areas of expertise are banking and finance laws, securitization - related matters, recovery of debts, suits, and arbitration matters. Apart from drafting various pleadings, he also advises/ gives opinions and strategies to clients on various litigation matters in various forums including the Supreme Court, High Courts and various other Tribunals across the Country. He has also briefed top Senior Counsels across the country for multinational clients.

Anushka Sarker is a graduate of KIIT University, having 4 years of experience in the area of Insolvency Laws, Recovery of debt suits and arbitration matters. As an Associate of Adhita Advisors, she is actively involved in various commercial matters, Pan-India. She has also previously worked with various Senior Advocates and have been involved in matters in various forums including the Supreme Court, High Courts and several other Tribunals across the country.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved