or

India’s FDI policy in retail was paused. But now buying your pair of “Armani” jeans and groceries from the same store is just an implementation away!

Government’s pro FDI in Retail stance, was interrupted but as a progressive community, we came through, with a “yes”. However, in a world of instant reliefs, will the benefits come instantaneously? Probably not,even the Policy tells the investor to “invest in backend support within 3 years of first investment”. It requires further penetration with substantial legal support before it becomes the “Big Reform Policy” which it promises to be.

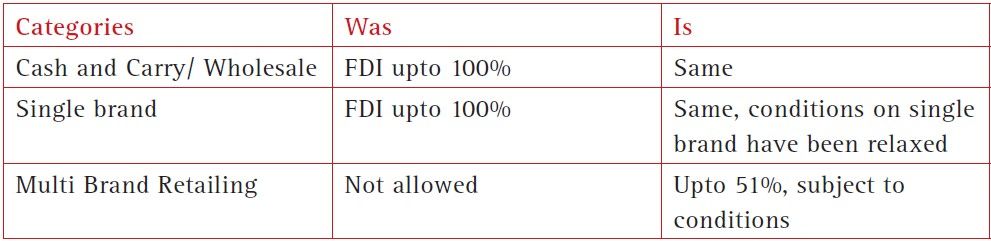

UPA relooks at FDI in retail, and believes conditional liberalisation in single and multi-brand retailing, is the way for India. Evolving FDI in retail is

Please bear in mind, the interjected proposal, does not put the investor applicant on the automatic route, it still has to receive the FIPB’s discretionary nod.

However, amidst, opposition uproar, the Government has remained firm. Spotlight is on India on this one.

The enthusiastic investor has to meet minimum investment requirement, invest inback end infrastructure within stipulated time frames, procure raw material from the small enterprises and still be restricted to cities which adopt the policy and have a populace of 10 lakhs. Given the cultural and political diversity India has, maybe it isn’t a thing to rejoice.

With having retained first right to procurement from farmers (investor would like to read as ROFR (right of first refusal) as opposed to the RFOP (right of first procurement)), the conditional policy seems to be creating sufficient traction to boost India’s fragmented retail economy, it recognises the potential of organised andunorganised retail sectors which can coexist. What it does not do, is achieve critical mass for the unorganised sector to flourish.

In a country where coke and sharbat-eazam co-exist so can kirana shops and Tesco/Carrefour if Government walks the talk for sustainability and co-existence. Evidently, the FDI will operate through the organised sphere through licensed retailers, corporate-backed hypermarkets, creating opportunity space for the unorganised retailers. The solution is in infusing innovation in this space.

Legible fine print on the policy, regulatory and implementation oriented environ committed to prevention of unfair practices, affordable institutional credit to unorganised retailers, proactive assistance to small retailers to upgrade and central enactments addressing the fiscal and social aspects of retail are all aspects worth debating. FDI in retail can be that valuable tool, for India in many ways, provided, over the opposition’s din the Government subscribes to an unfettered commitment for unified, sustained growth. Will it?

Shradddha Ray Menon is Associate Partner with TMT Law Practice. In her years as a corporate lawyer, she has engaged in mainstream Mergers and Acquisition practice including advisory work on India inbound investment, establishment of green field projects, due diligence audits in M&A and Corporate Finance briefs involving partial and 100% acquisitions. Having worked as in-counsel as well, her advice combines the law firm and inhouse perspective

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved