or

In continuation with the article that started in the previous issue, the second part is a detailed analysis of the merits and the demerits of crowd funding as an alternative means of raising finance.

On the face of it, crowdfunding offers many advantages as compared to the conventional means of financing business ventures. Some of the most evident benefits are enumerated as follows:

Every business requires finance to manage its activities. But finding the appropriate means of raising funds is a challenge due to the legal complexities involved in the current financial environment. The situation becomes much more difficult in case of start-ups and small and medium enterprises. Crowdfunding is a much more viable option as compared to the traditional sources of fundraising like banks which often deny giving loans for a lack of collateral. Financial crises of 2008 forced the banks to put a stringent regime of lending, making it very difficult for a startup to adhere to its strict standards and obtain a loan. Also, only a small number of businesses get the benefit of private financing from venture capital firms. Thus, crowdfunding emerged as a feasible substitute to raise funds with minimum legal hassles and formalities.

In this digital era, almost three-fourths of the world’s population uses internet. Internet has a wide reach in India too. It is prevalent even in some pockets of rural India. Crowdfunding being an internet based fundraising technique provides the start-ups an opportunity to approach a huge crowd as compared to the other methods which have only a limited approach. Thus, due to its easy accessibility, it enables an enterprise to raise funds within a short span of time. The best example of this is the Kannada film Lucia which raised around 51 lakhs through crowdfunding within thirty days. Also, crowdfunding helps in removing the geographical restraint, allowing people beyond the borders to invest in ideas which they feel have the potential of becoming a prosperous endeavor.

Sigar K. believes crowdfunding as an opportunity to mainstream the small businesses which were before marginalized by the customary sources of finance. Due to the unfavorable conditions and stiff competition, it was very hard for a new enterprise to sustain in the market. But with the evolution of crowdfunding, it can act as an ignition for new and innovative concepts which did not seem practical because of the risk factor involved. This scheme can provide an inspiration for many ventures to start business on their own without facing many legal complications.

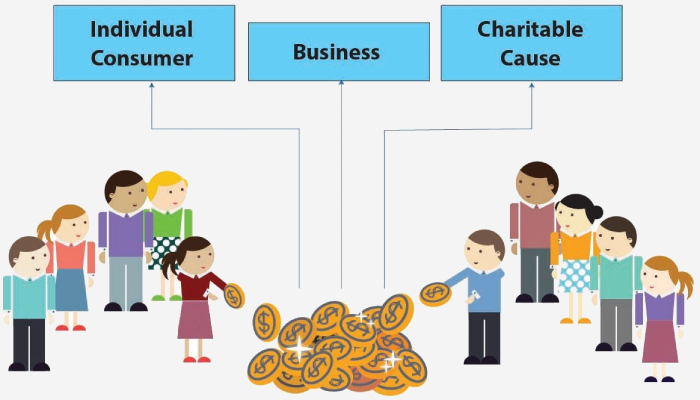

Crowdfunding enables the entrepreneur to raise funds at a lower cost because he directly approaches people who are willing to invest such as family, friends, neighbors, instead of the limited set of investors. It works on the basic mechanism of demand and supply. As crowdfunding involves collecting funds from a wider range of investors, the earlier limited supply base of investors is broadened helping it to cope up with the everlasting demand for credit.

The whole idea of crowdfunding is based on appealing a large audience to invest in a project. Ramsey (2012) emphasizes that “they can gauge the potential for a successful start-up of the business based on the public’s response to the request for support”. Due to its wide reach, crowdfunding can act as an effective marketing tool. Crowdfunding introduces a venture’s overall mission and vision to the public. It can help in increasing the awareness and popularity of the product. Crowdfunding helps in word-of-mouth marketing through offline and online means. It makes investors automatic ambassadors for the business. One of the best examples of this can be seen in case of non-profit organizations like Profit Renewal which raised $77,000 on Giving Tuesday, an organization founded in 2012 by New York’s 92nd Street Y in partnership with the United Nations Foundation which has acquired the shape of a global movement recently engaging more than 30,000 organizations over the globe.

A creator gets an idea about the viability of his product depending on the interest that people show towards his produce. Thus, a crowdfunding campaign helps in making modifications in the product so as to satisfy the public demand and thus increases the probability of making it a more successful business venture. It boosts confidence in the entrepreneur regarding the profitability of his venture.

All or nothing model All the crowdfunding platforms work on the principle that either the whole targeted fund is raised or if not, nothing is given to the borrower. If the business doesn’t reach its funding target, any finance that has been pledged will usually be returned to the investors and the business will receive nothing. Hence the borrower either receives everything or nothing at all.

Though crowdfunding may seem to be a simple route, the probability of getting finance can vary significantly. The idea needs to be outstanding in order to attract public attention. Even though crowdfunding seems like an alternative for the traditional financing mechanism, there is no surety that the venture would be financed. Usually, the public are willing and enthusiastic for funding an exhibition or a documentary film or anything likewise but raising funds for working capital of an ordinary business may not attract the requisite funds. In these instances, companies are better off securing lines of credit or merchant cash advances. Further the time which an idea might take to get popular and then get crowdfunded may turn out to be too long, making it a very slow process.

Crowdfunding is viable for a start-up’s capital requirement but it cannot fulfil its continuous fund necessity. It is not viable for long term financing. It can be used for funding a project initially but cannot be always be relied upon. Further even if the investors get attracted to the business project in the first instance, it is very unlikely that they will continue to fund over a period of time. In case of start-up, it would be even more problematic to get funds due to its constant capital requirements.

It is very difficult to raise a large sum of money by way of crowdfunding. Though there are a large number of contributors, only a minuscule amount is collected from each one of them individually and thus the business target is never met. The highest amount that has ever been raised through crowdfunding was by Star Citizen, an online space trading and combat video game by Cloud Imperium Games, which managed to raise USD $65,000 this year. Otherwise the average finance raised varies between $2000 to $5000 USD which is too less as per requirements of a sizable venture.

An innovative idea may appeal to the public at large but it always involves the risk of being copied. Similarly, though crowdfunding seems safe and certain, it involves a significant amount of risk. It requires disclosure of insider information which might result in infringement of copyright. For establishing the credibility of the business in order to gain trust of the public, the campaign might require to disclose some vital data regarding the business. Exposure of such insider information may be misused by the competitors which is not healthy for any business.

If an idea fails to be efficacious it will have an adverse effect on the reputation of the business venture. Crowdfunding through online sources helps in getting feedback from the general public, but in case there is negative feedback, it may disturb the image of the business. After not being crowdfunded, if the same business goes to ask for a loan from the traditional sources, its credibility might be questioned. There may be many reasons for such a failure such as disorganized management, scarce funds, etc. Many successful crowdfunding campaigns can face certain challenges like lack of the necessary logistics and manufacturing capacity to meet the demand generated by their campaign.

Along with the risks involved for the business, even the investors have the risk of being defrauded. The crowdfunding platforms just do a preliminary check on the legitimacy of the business, but they are not responsible if the business doesn’t provide the investors with the promised gifts. Further, they are also not responsible if the said money is not used for the specified purpose. Hence the investor remains within a blindfold. As and when the business expands and the number of shareholders increase, there is a high likelihood that a number of accounting problems will be faced by the business. Also, there is a potential risk of an idea being stolen by funded investors or bigger corporations. Lack of knowledge mechanisms to protect one’s idea from being stolen and the inability to defend oneself in a court of law in such cases puts the entrepreneurs in a very vulnerable position.

When funds are raised from the public, it is essential to keep an account of all the investors. But in case of crowdfunding there are innumerable investors. Also they invest through an online platform and legally there are no disclosure requirements yet. Hence keeping an account of all the investors becomes painstaking and problematic

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved