or

When the whole system is pitted against you, the only thing you can do is hope that justice will finally prevail! Jignesh Shah’s story is just that.

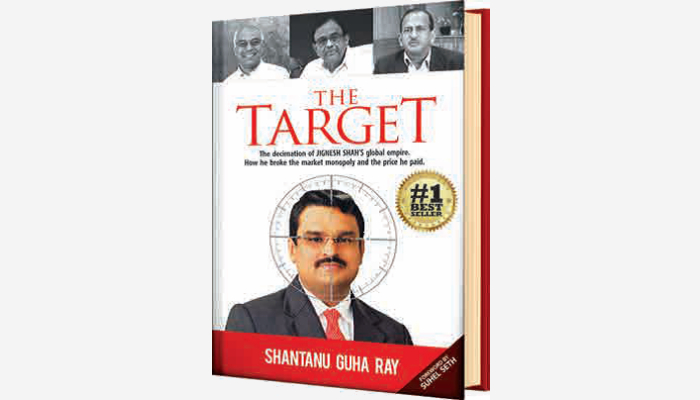

Senior journalist and author Shantanu Guha Ray has come out with his latest bestseller, The Target that is essentially a real life portrayal of Shah, the poster boy of financial markets, who was targeted by vindictive authorities because he broke the market monopoly for the larger good of one and all.

Guha compares Shah’s life and times with that of John Galt – the protagonist of Atlas Shrugged, the hugely popular novel of 1950s by Russia-born American author, Ayn Rand. He draws remarkably close parallels between the two champions both of whom challenged the system, fired a revolution that broke the shackles of a monopolistic regime in the interest of all those who wanted fair play in the markets.

The book talks about the larger picture and how the National Spot Exchange Limited (NSEL) crisis was just a tip of the iceberg exposing the politico-bureaucrat nexus against Shah and his Financial Technologies India Limited (FTIL). Jignesh Shah’s glory days when he was known as the Czar of the Exchanges seemed to ruffle a lot of feathers, especially his rivals, which in this case was the National Stock Exchange (NSE) group. Shah’s entry into the financial markets was constantly challenged by many collaborators. Shah was ahead of his time and had done the unthinkable.

A strategy for his downfall, hatched over the years never took place until the NSEL payment crisis. The vested interests found a grey area in the NSEL operations and used it against Jignesh Shah and FTIL by triggering the NSEL crisis. The aftermath was mayhem for Jignesh Shah’s companies. Unprecedented decisions, taken in haste, without any validated evidence against FTIL brought down his empire. It finally did what they were waiting to do for 10 years – destroyed FTIL and Shah’s innovations.

Through a seamless flow, the book brings out the core – How K P Krishnan, then Finance Minister P Chidamaram’s most favourite bureaucrat in his Ministry and Ramesh Abhishek, the then chairman of commodities markets regulator, the Forward Markets Commission (FMC), took the rising competition against the NSE due to FTIL’s phenomenal rise as a potential threat for their interest. The NSEL crisis was a smokescreen to the ulterior motive which was to obliterate FTIL group and Jignesh Shah’s innovative spirit. The crux of the book is the strategic planning to execute the plot against Shah and FTIL.

“If such an unconstitutional merger order is mindlessly implemented much against the constitutional rights of a publicly listed company, it will have far-reaching consequences on the flow of Foreign Direct Investments into India, something that the country is currently struggling for.”

The seeds of the crisis were sown way back in 2012 when the FMC misguided the Department of Consumer Affairs (DCA) about the so-called violations made by NSEL. What is shocking is, the FMC did not even check legal validities before shooting off such a letter to the DCA. Equally shocking is the fact that following FMC’s highly irresponsible missive, NSEL was closed down abruptly.

The sudden closure which led to the payment crisis on NSEL could have been averted and easily solved had the FMC taken timely actions like other prudent regulators against the 22 entities that had defaulted on the payment and had also admitted to holding up the entire money not only to the FMC but also to the investigative agencies.

Instead, it deliberately kept the crisis alive and trained all its guns against Shah and his FTIL group, since, Guha says, the larger motive was to kill FTIL and target Shah. In its attempt to do that, the FMC took one executive action after the other, defying all logic!

All these unwarranted actions by the FMC including the “Not fit and proper” order that threw Shah and his FTIL group out of exchange businesses were no less than a body blow aimed at breaking the spine of FTIL group. Corporate circles were abuzz with legal questions as to how the FMC could declare FTIL ‘Not fit and proper’ simply on the basis of a onesided report of a non-audit firm!

As if this was not enough, the FMC completely overstepped its brief and went a step ahead in making a flawed recommendation to the Ministry of Corporate Affairs (MCA) to merge NSEL with FTIL, something that was beyond its purview. Surprisingly, the MCA readily heeded its recommendation and issued the merger order, an executive fiat that remains unsurpassed in the annals of India’s corporate history. Obviously, FTIL challenged the merger order in the Bombay High Court.

Guha points out that the merger order is flawed since, under the Companies Act, no two companies can be forced to merge against the sovereign will of its shareholders and it violates the sacrosanct concept of ‘limited liability’ and ‘lifting of corporate veil.’

If such an unconstitutional merger order is mindlessly implemented much against the constitutional rights of a publicly listed company, it will have far-reaching consequences on the flow of Foreign Direct Investments into India, something that the country is currently struggling for.

This was not all. The FMC also recommended the supersession of the FTIL Board despite the fact that the Ministry of Law & Justice had opined that this could not be done as it was ‘unlawful’ to do so. Subsequently, the MCA moved the Company Law Board (now known as the National Company Law Tribunal).

“In view of all this, Guha feels that when the first two pillars of democracy, the legislature and executive, end up ganging against just one man and one company, the other two pillars, the judiciary and the media, should rise up to the occasion to fulfil their dharma so that truth ultimately prevails.”

After destroying his institutions began the hounding of Shah when he was arrested thrice by different investigative agencies on the charge of ‘non-cooperation’ including the Economic Offences Wing of the Mumbai Police, the Enforcement Directorate and the Central Bureau of Investigation. On each of these occasions, he was released on bail by the courts stating he was arrested without evidence and when not a single paisa had been traced to NSEL, FTIL or Shah himself. In fact, when the ED arrested him, the PMLA court granted him bail terming his very arrest ‘illegal.’

Close on the heels of the ED arrest, the CBI took Shah in, albeit not in the NSEL case but on charges related to the licensing of MCX-SX. The irony was, the CBI took this extreme step when the highest court of the land—the Supreme Court—had ordered the Securities Exchange & Board of India to grant recognition to MCX-SX after being satisfied that it had complied with all legal requirements!

These repeated arrests drew severe flak from various quarters and the legal luminaries were up in arms terming it as the high-handedness of the agencies aimed at the character assassination of Shah by tarnishing his image.

Guha quotes K T S Tulsi, eminent Supreme Court lawyer, who said:“…the police cannot arrest a person on the same allegations, time and again, on the mere pretext that he is not co-operating…that will be a complete abuse of the process of law…not willing to confess is a constitutional right of every citizen. You can’t arrest a person for not cooperating…This is gross misuse of power…”

In view of all this, Guha feels that when the first two pillars of democracy, the legislature and executive, end up ganging against just one man and one company, the other two pillars, the judiciary and the media, should rise up to the occasion to fulfil their dharma so that truth ultimately prevails.

The LW Bureau is a seasoned mix of legal correspondents, authors and analysts who bring together a very well researched set of articles for your mighty readership. These articles are not necessarily the views of the Bureau itself but prove to be thought provoking and lead to discussions amongst all of us. Have an interesting read through.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved