or

India Awaits Next Legal & Regulatory Revamp

The NaMo Government has been one of the most aggressive efforts India has seen so far when it comes to revamping the legal and regulatory framework India Inc. was dwelling in. Undoubtedly, the Government has created a very aspiring benchmark for all legislators in times to come. While the first term comes close to its completion, one ponders what could one expect in the next term. As we approach towards the 72nd Independence Day, Lex Witness draws up a few of the signature moves NaMO times brought into the nation’s legislative fabric

The list is long and includes major economic reforms such as the ‘one nation one tax’ regime under the Central Goods and Services Tax Act, protection of homebuyers under the Real Estate (Regulation and Development) Act, introduction of new and tougher laws to deal with economic offenders, protection of home buyers under the Insolvency and Bankruptcy Code, 2016, tougher laws to curb and control heinous crimes like rapes etc., extension of paid maternity leave to 26 weeks under the Maternity Benefit Amendment Act and other laws aimed at helping the underprivileged and poor assert their rights.

Rapid penetration of the Aadhaar scheme that is set to become the world’s largest biometric identification system comes across as a befitting example of how the Government altered the existing law to benefit weaker sections of the public.

Interestingly, the concept of Aadhaar which is a 12-digit unique identification number assigned to each person was conceived in the year 2009 by the incumbent ruling government. It set up the statutory body Unique Identification Authority of India under the leadership of Nandan Nilekani which issued the first Aadhaar card in

September 2010. However, it was only under this Government that the project could lead to its fruitful end by introducing the Aadhaar (Targeted Delivery of Financial and other Subsidies, Benefits and Services) Act, 2016 as a money bill in the Parliament on 3 March 2016. It was passed by the Lok Sabha a few days later on 11 March. A number of amendments were made to it by the Rajya Sabha – all of which were rejected by the Lok Sabha. Since it was introduced as a money bill the Lok Sabha could exercise an upper hand to pass the bill.

At this juncture is where the Government attracted obvious criticism in the way the legal procedure was modified to best suit its need to push the scheme. A challenge to this was brought to the Supreme Court by economist and Congress politician Jairam Ramesh in the form of a suit. He alleged that the act was unconstitutional and that it was incorrectly introduced as a money bill in the Parliament. The correctness of the due process adopted by the Modi government is yet to be decided by the Supreme Court.

While the Government was busy with securing the approvals that would serve as the legal backbone of Aadhaar, it was also actively enrolling citizens under the scheme. The enrolment process was initially slow with over 260 million enrolments till the beginning of 2013. This figure rocketed to a billion enrolments till mid-2016 as the Modi government aggressively took up the project from 2014 onwards. By the beginning of 2017, Aadhaar’s saturation rate was 99% of the Indian population with a total of 1.11 billion Aadhaar cards having been generated. The spiraling in the upward trend continued in the months that followed.

Enrolment of citizens before the process could receive a statutory backing also garnered criticism. Lawyers argued how the government could get citizens to part with their personal data in the absence of a legal backing of some kind. Skepticism also seeped into other aspects of the scheme such as the privacy concerns surrounding the data taken from citizens, its security, and to what end this data could be used by corporates. The Facebook-Cambridge Analytica data leak fiasco that broke out recently strengthened this criticism. A parade of privacy activists, lawyers, and individual campaigners rebelled against the

On 24 August 2017, the Supreme Court declared privacy to be a fundamental right in the country. This opened up a new round of trouble for Aadhaar as the judgement said, “But the data which the state has collected has to be used for legitimate purposes… and not unauthorizedly…” corporates would now have to explain how the demand for a citizen’s data that had been collected was “fair, just and reasonable”.

severe glitches (privacy, security, no legal backing and overstepping of constitutional mandate). Its architecture has been attacked for the fear of a resultant surveillance state, glaring privacy and security issues.

As we stand today, corporates using data generated under Aadhaar are bound by provisions of the Contract Act and the Information Technology Act regarding its use and sharing with third parties. The data protection law that is expected soon will provide more clarity about how sensitive data may have to be dealt with. Large international corporates find it difficult to store data in one country as the data has to interact and may have it across servers in different countries. They would have to abide by the data protection laws of the other countries too. This, however, did not derail the Government’s plan as it continued to push Aadhaar across all quarters. What started as a biometric identification program for providing welfare schemes/subsidies to the poor suddenly became a formidable national identity number that was being mandated for Government schemes and services like PDS, LPG, bank accounts, midday meals, phone number, driving license etc.

The realm of the Aadhaar Act under which there is an exhaustive list under Section 7 for which Aadhaar can be mandated was sidelined as the Government mandated its linking to services (non-welfare or subsidies related) beyond the Aadhaar Act. Deadlines for such extension were extended from time to time to achieve greater penetration despite a challenge pending in the country’s highest court. The Government did not leave a stone unturned in pushing Aadhaar and the benefits attached therein for the greater good of the nation, at its behest changing the legal settings the country.

The fate of Aadhaar with all its hurdles currently rests in the hands of a constitutional bench headed by Chief Justice Dipak Misra that is soon expected to pass its verdict on a batch of petitions challenging its constitutional validity and other facets.

In a bid to achieve transparency and greater accountability to builders in the real estate sector, the country was greeted by the Real Estate (Regulation and Development) Act, 2016 or RERA that came into effect on 1 May 2017. This required all the states to set up a real estate regulatory authority. Before RERA there was no regulatory authority of this nature in the country, the lack of which resulted in the home buyers being taken for a ride or their funds swindled by builders of projects they invested in.

Being the first of its kind initiative, RERA was welcomed as it aimed at providing the security to homebuyers through watertight procedures of authorization and penalties in case of its breach by builders. In contrast to older practices that were opaque, it mandated properties to be sold based on carpet area and not the super built-up area. It sought to ensure that all commercial and residential projects (beyond 500 sq meters or having eight apartments under construction) were registered, completed in time and if the developer failed to do so, interest would be paid to the buyer for the delay.

One thing RERA has managed to deliver on in its short stint of 1 year is the sturdy and adequate protection that it offers to home buyers. Before this, developers had it easy and they would easily cheat them, delay delivery or possession of property or swindle home buyers’ funds. With a codified law in place, homebuyers are armed with remedies they can take against violation of their rights. This ensures timely delivery of properties and a safe investment of their funds.

“The most important impact which was perceived during the conception of RERA was to bring in confidence among buyers towards this sector. This is definitely a remarkable reform witnessed by this sector and the benefits are slowly coming to light. We have seen the confidence building up amongst buyers and our internal market survey reveal that this is due to the easy and efficient dissemination of information about under-construction and newly launched projects. Hence, we believe that RERA is ‘the’ differentiator and can bring in the required volume of sales in the coming years”, said Dr. Samantak Das,

Chief Economist & National Director – Research, Knight Frank India.

Highlighting the ways in which RERA protects and inspires the trust of home buyers, Amit Modi, Director of real estate company ABA Corp and Vice President of CREDAI in Western UP said, “Earlier there was no redressal mechanism for either delay in obtaining occupancy certificates/ possession of the project. But through RERA there is transparency in the system on this aspect. The requirement of keeping 70% of the project money into an escrow account gives assurance of money being available at every stage until the project is completed and handed over to the consumer. Also, one of the major benefits for home buyers is that if the project completion is delayed, the developer has to pay the same interest as the EMI paid by the buyers. This will enable the government to oblige the developer to stay loyal to their customers.”

While the law was enacted to put in motion an institutionalized infrastructure – one that safeguards a buyer’s interest, it has still to be reaped for achieving the real estate setting that the Modi government had envisioned.

According to Amit Modi, multiplicity of permissions and approvals that developers are required to secure and the lack of single window clearance could take anywhere from 18 to 36 months resulting in delay. “An online single window clearance with the bare minimum human interface and precise deadlines for approvals will not only delay delivery of projects by at least 3 years but also add to the cost of the project by at least 15% which will be passed on to consumers. Going online will also boost transparency and curb the scope for undue gratification in granting permissions.”

Another major hurdle is the slow rate at which it is being executed and the manner of compliance by different states. It is currently notified in 23 states and 7 union territories. Notification in the northeastern states of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura and West Bengal is still pending. Being notified in 23 states out of 35 (excluding Jammu & Kashmir) might not come across as a conservative figure but what is troublesome about it is that the provisions of the central law are being diluted by few states and not being implemented in the spirit it was intended under the RERA Act.

Out of the states where it has been notified, 3 of them – Maharashtra, Punjab and Madhya Pradesh have a permanent regulatory authority in place while the rest are still functioning with interim regulators for now. This stalls the process of effective implementation as it serves as a temporary fix rather than a permanent measure.

For instance, there are several states that have adopted a lackadaisical approach at its implementation by safely diluting the definition of ‘ongoing projects’. By doing so, states of Uttar Pradesh, Andhra Pradesh, and Kerala, have narrowed down the purview of the law to suit themselves and kept out properties that should have otherwise been the subject of the RERA act. As a result of this practice, home buyers who are adequately represented under the RERA Act are unable to fight for timely completion and delivery of their projects.

“The most important challenge as of now is implementing RERA across all the states in India. In the last one year, only three states have appointed a full-time regulator while 23 states and union territories are functioning with an interim regulatory body. This comes across as a half-hearted effort which will render RERA incapable of achieving its desired objective. Unless and until a full-time regulator is brought in exclusively for RERA, the law will not be fruitful. The lack of a full-time regulator with a full-fledged office and efficient information dissemination is an important challenge which needs to be overcome to infuse confidence amongst buyers and ensure the effectiveness of RERA”, Dr. Das of Knight Frank India said.

Das also handpicked the state of Maharashtra as being a role model for other states to emulate in its implementation of the RERA law in letter and spirit. Out of the total projects registered under RERA, 62% are from Maharashtra alone. A permanent regulator has been appointed, the office is in place, judgments on disputes have been passed swiftly and information dissemination has been done real time, he said in this regard.

The problem is compounded by the states’ laid-back attitude prevails is when it comes to effective implementation by way of information shared on the current and open real estate projects on websites they are required to maintain under the law. Half loaded information of real estate on their websites is preventing home buyers from being able to make good choices and

Investment decisions for themselves. This again points towards a lack of effective compliance under the central law.

States have also adopted a similar approach by reducing penalties laid down under the central law. By providing for compounding of offense in case of violation of the RERA act by several states, the essence of the law which calls for strict liability stands hampered. Another way in which the law may be losing its objective along the way is because of non-clarity of clauses dealing with a penalty to be paid in case of structural defects arising within the first five years of handing over possession of the property to a buyer.

Overall, the real estate sector has not shown a major price haul because of RERA and wherever there has been a change, it is because of other factors such as the location, price of land, price of raw material, supply and demand, so on and so forth. Experts say the insignificant rise of about 5-7% could be because of compliance and other factors that would vary from case to case.

Even though RERA has spun around a positive change in the real estate sector is evident, RERA’s permanent outcome is a long-term project. The law has made it clear that only credible developers who abide by its strict rules of transparency will be able to survive in the future. Its enduring force will be seen when it successfully causes a blow to unscrupulous and unorganized developers and offers a clean level playing field to law-abiding developers through an online transparent single window clearance mechanism.

The real estate sector has witnessed a complete overhaul during the tenure of the BJP led-Modi government as it aims to achieve transparency in the real estate market by backing the RERA law with other corrective amendments such as the Land Acquisition Rehabilitation and Resettlement

To avoid overburdening the courtrooms, the new law will only apply to cases where the offense is worth ` 100 crore or more. Once passed, it will utilize the infrastructure of the special courts set up under the Legal experts believe the main reason for economic offenders being able to evade the country without any accountability has got to do with cumbersome and time-consuming extradition process between India and other countries that they could take advantage of.

(Amendment) Bill, 2015 and the Benami Transactions (Prohibition) Amendment Act, 2016.

Benami transactions simply mean those that are undertaken to acquire property that is ‘without a name’ or under a ‘fictitious name’. Such property does not have a legal owner and is usually purchased through black money.

In a Supreme Court ruling of 1980, namely Bhim Singh v Kan Singh, the court defined benami property to mean— “where a person buys a property with his own money but in the name of another person without an intention to benefit such other person, the transaction is called benami and the property is called benami property”. It was held that in such transactions, the transferee holds the property for the benefit of the person who has contributed the money for the purchase and he is the real owner of the property. The property may be movable or immovable. In certain cases, the owner of the property may not be aware of, or, denies knowledge of such ownership.

Through the amendment, the punishment under the law has been made stringent where instead of the earlier imprisonment of up to three years, or a fine or both, an offender will face imprisonment of up to seven years and a fine which may extend up to 25% of the fair market value of the benami property. It also sought setting up of an appellate tribunal to hear appeals arising from complaints made against the adjudicating authority that is tasked with conducting inquiries into such transactions. To ensure timely disposal of appeals, a timeline of 1 year was established under the amended law.

Although it’s still in its formative stages, it has brought with itself a positive trend by boosting buyer’s confidence and put in place a system to clean up the mess the sector has seen through the years. Its hallmark virtue of the practice of ensuring that only a lawfully owned property can be allowed to transacted guarantees that India can expect a structured and transparent real estate market in the years to come.

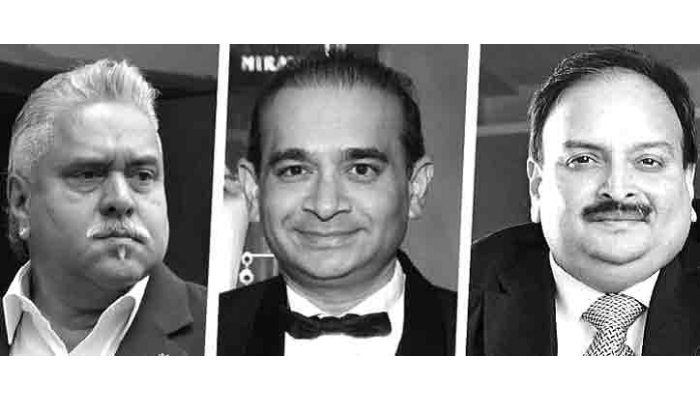

In the last 4 years, the Modi government has been witnessing to one too many multi-crore scams and willful defaulters such as liquor baron, Vijay Mallya, jeweller Nirav Modi and Mehul Choksi who have successfully managed to evade the wrath of the legal process. The government spent months tracking Nirav Modi back to the country in connection with the `14,356 crore fraud at Punjab National Bank. He fled the country by taking advantage of the loopholes in the prevailing money laundering laws. It was then that the Modi government decided to step in through the Fugitive Economic Offenders Bill that was placed before the Lok Sabha in March in the budget session. On 21 April, the union cabinet approved the promulgation of the Fugitive Economic Offenders Ordinance to confiscate assets of a fugitive from the law. But its timing before the upcoming 2019 elections could not be a mere coincidence, mainly because the verdict on Mallya’s extradition is pending and attempts to attach his property are underway. Through the new law, the government aims to be empowered to confiscate all the property of an economic offender who has fled the country. Under the existing laws, courts can only attach those properties of the offender that are secured or those that are proceeds of the alleged crime of money laundering. There is already a three-step process for confiscation of property of an offender under the PMLA (Prevention of Money Laundering Act, 2002) but the process is a long drawn one.

While being introduced in the Lok Sabha, it was opposed by BJD MP, Bhartruhari Mahtab on grounds that it would be in violation of the fundamental rights of the citizens to confiscate and sell their properties before being declared guilty by a court of law, she added.

The ordinance, by itself, will not succeed in bringing back Vijay Mallya but it will set a dangerous precedent where the Government can contort established legal principles to deal with exceptional situations.

This is definitely a step in the right direction as it will strengthen the current money laundering law and put pressure on the fleeing defaulter by automatic confiscation of all his properties. It will help to establish the rule of law against fugitives who will be forced to come back to the country to face trial and fight the charges against them. The trickle-down advantage will be enjoyed by banks and other financial institutions who can expect a quick recovery at their end.

An example of positive reinforcement this law is expected to bring can be seen through the Enforcement Directorate recently moving a Mumbai court to declare Mallya who is absconding a ‘fugitive offender’ and confiscate assets over Rs 12,500 crore under the ordinance.

Evidently, the BJP’s approach to delivering on its promise of boosting the economy, reviving the real estate sector and cracking down on offenders by taking the support of the law has been proactive. Its ambitious sweep on legislations over the years have proved to be a mirror to its commitment of not wasting any time in pacing forward the economic and social progress of India

The LW Bureau is a seasoned mix of legal correspondents, authors and analysts who bring together a very well researched set of articles for your mighty readership. These articles are not necessarily the views of the Bureau itself but prove to be thought provoking and lead to discussions amongst all of us. Have an interesting read through.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved