or

On 13th June 2018, the Ministry of Corporate Affairs notified Section 90 of the Companies Act, 2013 (“Act”) and the Companies (Significant Beneficial Owners) Rules, 2018 (“SBO Rules”). Both aim to make transparent a company’s ownership bytracing the identity of the individuals who ultimately control the company.

Section 89 of the Act requires beneficial interest in an Indian company to be disclosed. Section 89 (10) provides that beneficial interest in the shares of a company includes, directly or indirectly, through contract or otherwise, the right of a person to exercise rights attached to such shares or receive or participate in any dividends or other distribution in respect of the shares.

Section 90 defines a Significant Beneficial Ownerand requires every such individual who, either by himself or with others (including a trust and persons resident outside India) holds beneficial interest of not less than 25% percent or such other prescribed percentage (reduced to 10% under the SBO Rules) in the shares of the company or has the right to exercise or the actual exercising of significance influence or control over a company, to declare the same.

The SBO Rules further clarify the definition ofa Significant Beneficial Owner. A Significant Beneficial Owner denotes a person referred to in Section 90(1), who holdsultimate beneficial interest of not less than 10%, but whose name is not entered in the register of members as the holder of such shares. Global depository receipts, compulsorily convertible preference shares or compulsorily convertible debentures are treated as ‘shares’.

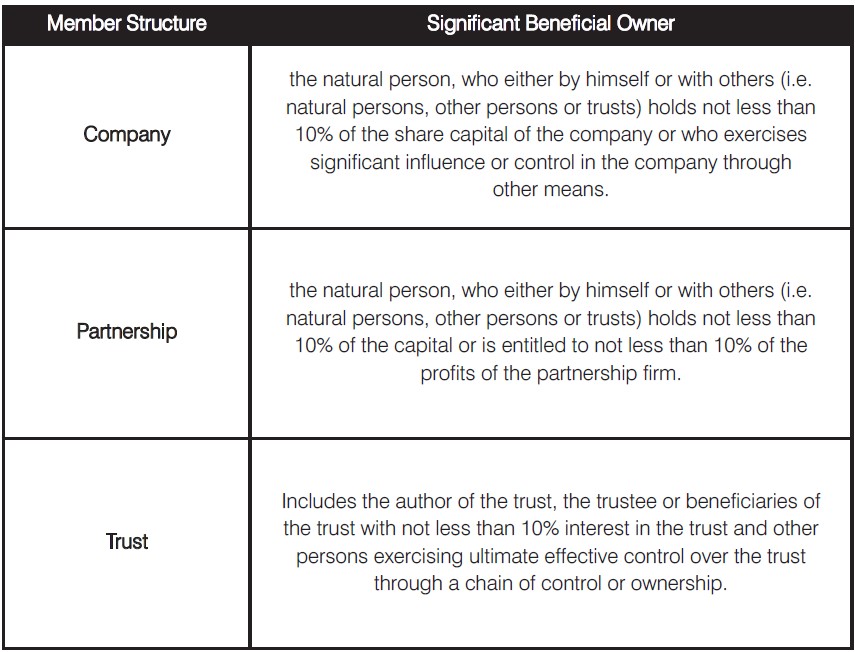

The SBO Rulesdetermine who a Significant Beneficial Owner is depending on the legal structure of the member and provide that:

Where no natural person is identifiable in case the member is a partnership or a company, the Significant Beneficial Owner is the relevant natural person who holds the position of senior managing official. The SBO Rules do not apply to holding of shares of companies or body corporates in case of pooled investment vehicles/investment funds such as mutual funds, alterative investment funds, real estate investment trusts and infrastructure investment trusts regulated under the SEBI Act.

A Significant Beneficial Owner is required to file a declaration in Form No. BEN-I to the company in which he holds significant beneficial ownership. Form No. BEN 1 was required to be filed within 90 days of the notification of the SBO Rules, i.e. by 11th September, 2018. The MCA has however, vide clarification dated 10th September, 2018 extended the effective date till a revised Form No. BEN-1 is released.

A company is required to:

Failure to file Form BEN-I is punishable with a fine ranging between Rs. 1,00,000 to Rs, 10,00,000 (for a continuing offence an additional fine of Rs. 1000 for every day the failure continues). A company that does not comply with the SBO Rules and every officer who is in default, is punishable with a fine ranging between Rs. 10,00,000 to Rs. 50,00,000 (for a continuing offence an additional fine of Rs. 1000 for every day that the failure continues). Willful suppression of material information or submission of false information is also a criminal offence under the Indian Penal Code.

The intent of the SBO Rules is clear. By tracing those who hold ‘ultimate’ control over companies, the SBO Rulesseek to pierce the corporate veil surrounding complex corporate structures. Combating money laundering, benami transactions, tax evasion and terror financing – many objectives have been attributed to the SBO Rules. Their effectiveness however, will be determined over the course of time.wssss

Ashima Obhan is a Senior Partner at Obhan & Associates and heads the Corporate and M&A practice. She has more than two decades of experience in foreign investment, M&A, joint ventures, cross-border transactions and commercial disputes. Ashima advises domestic and multinational corporations on commercial and regulatory matters, cross-border acquisitions and India-entry strategies, and is also well regarded for her work in private equity and venture capital investments.

Vrinda Patodia is part of the Corporate Law practice of Obhan & Associates and heads the Pune office. She advises on a broad spectrum of corporate commercial law matters and regularly represents clients engaged in the technology, media and entertainment, financial services and manufacturing sectors. Vrinda has extensive experience advising on cross-border transactions, investment deal structures, joint venture transactions and advising foreign companies on setting up in India. Vrinda routinely advises foreign clients and their Indian subsidiaries on issues pertaining to corporate governance and general compliance advisory and has an in-depth understanding of the ever-evolving regulations related to foreign and overseas direct investments. She has been ranked by BW Legal World as one of the 40 under 40 Lawyers and Legal Influencers, 2021 and was also ranked by Asian Legal Business in its 2022 India’s Rising Stars list.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved