or

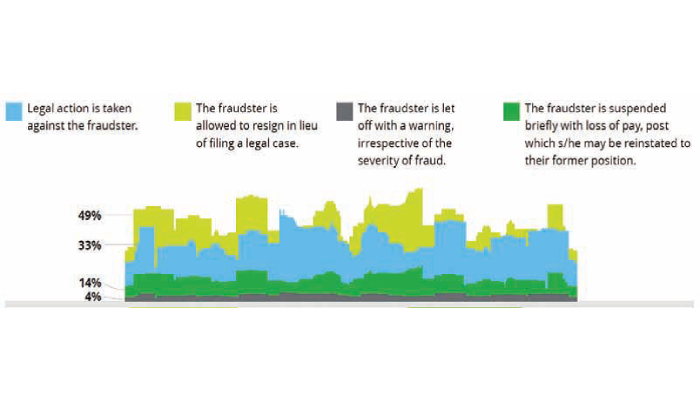

Source of the image: India Corporate Fraud Perception Survey, Edition III released by Deloitte India

Traditionally Indian organisations have been hesitant to pursue legal recourse in case of fraud owing to the slow pace of the judicial system in India, high litigation expenses, and the relatively incommensurate penalties provided for under the law.

However, our recently released Deloitte India Corporate Fraud Perception Survey, Edition III indicates that this trend is now changing. Once the fraud was ascertained, the fraudster was allowed to resign in lieu of filing a legal case in the majority of cases (49%). However, a third of respondents indicated that they took legal action against the fraudster. The rest of the respondents either chose to suspend the fraudster briefly and/or let the fraudster off with a warning.

We believe this may be the result of the slew of legislations passed by the government in recent years and efforts taken to resolve cases under them in a time-bound manner (the Insolvency and Bankruptcy Code is a case in point). In such a situation, it is essential to understand how to preserve evidence in a legally acceptable manner. In our experience, most internal fraud prevention units and internal audit teams prefer to work with third party experts for this activity as well as for quantification of losses.

To seek better outcomes from legal recourse to corporate fraud, organisations need to ensure that they are adequately prepared to support the case they intend to file. Below are some key considerations:

There is also recognition among corporates of the fact that a change in culture towards zero tolerance to fraud is essential to prevent future instances of fraud. While institutional measures are necessary to impart education and awareness among employees, it is also essential that line managers create an environment that is conducive for their teams to raise concerns without fearing retaliation or bias. In our experience, open discussions within teams on misconduct and malpractice, alongside managers living and demonstrating ethical behaviours can accelerate the creation of an ethical enterprise.

Amit Bansal is a Partner and leads Dispute and Litigation Advisory as well as Antitrust and Competition Advisory within Deloitte’s Forensic practice in India. He has an overall experience of over 23 years across large organisations, mainly focused on economic and financial analysis and investigating economic and financial crimes. He has also worked on some large and complex commercial disputes cutting across sectors, predominantly in infrastructure, construction, oil and gas, real estate and mines and minerals. He is a regular speaker in various public and private forums covering aspects like sectoral issues and strengthening ethical practices in business.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved