or

IP is the new age intangible asset everyone is talking about. But how exactly does this asset help the business? The ultimate goal of creating IP assets is to get value out of them for the business, more specifically money. At the end of the day, a profitable landscape is the most important thing for any business.

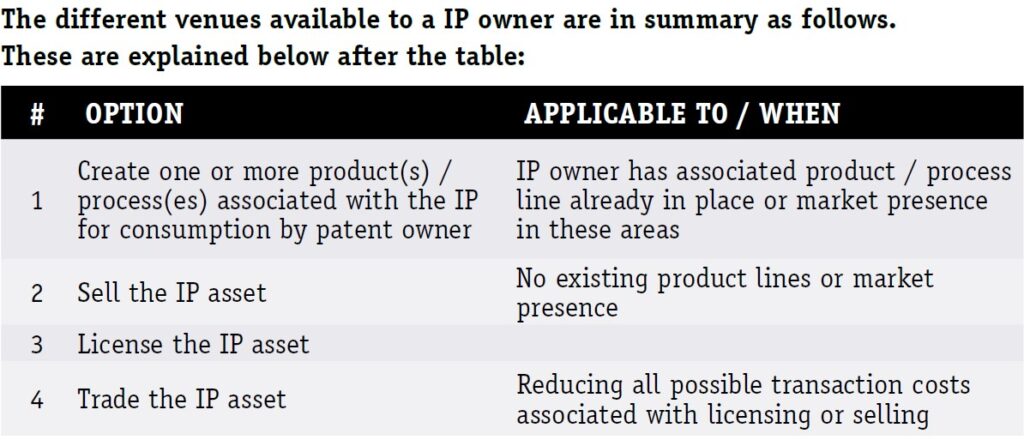

There are various options available to get the most bang for your buck, each however has its own merits and demerits. Usually a business employs a mix of these options considering what their IP portfolio actually looks like and at what stage of maturation their organization IP culture is at.

Essentially, there are 3 main ways in which IP, particularly patents and designs, can be monetised. First, IP can be used to create a saleable or marketable product or product line to secure a monopoly in that relevant product market. The benefit of this option is that the IP owner has complete control on how (s)he wants to convert that IP into a product, how (s) he wants to market it or sell it or decide a price for it etc. The demerit is possibly that the time and the investment that it takes to convert a patent or a design to a product is comparatively large including the time taken at the prototyping stage and testing stage etc. However, this option does work very well for a lot of businesses specifically those which have dedicated research and development units.

The second option is to treat the IP asset like any other asset and sell it to an interested buyer to get instant earnings. This can be the case in situations where the IP owner doesn’t have an existing product line, market presence or if the IP owner does not want to enter that product space. This is a comparatively quicker option and more since this methodology is like the sale of any other asset. However, the downside of this option is substantial loss of control over major decisions pertaining to the commercialization and product conversion of the IP asset and in a single onetime payment.

The third way to make money from an IP asset is to license it to one or more interested parties and earn either a lump sum i.e. a onetime payment from the buyer or a share or a percentage of profit or the sale revenue on a periodic or per sale basis as royalty. This can also be done if the IP owner does not want to enter that market space. If in case the IP owner wants a dedicated licensee i.e. only a single user of the IP and no additional developers or sellers of the product resulting from the IP, the IP owner can enter into an exclusive arrangement or license agreement with the licensee. This also is a comparatively quicker option compared to the first option with less effort and investment to actually produce a product related to the IP owned. This model also works well for a lot of businesses, especially those who prepare by diversifying their IP portfolio so that it can be licensed to other different parties.

There is also a fourth way which is to put up the IP asset on an IP exchange. It is, at present, a fairly new concept, at least in India. This option, instead of involving direct selling or licensing, allows the IP owner to have a look at other available IP belonging to other players and to trade in IP assets. Unlike the previous options, this one doesn’t require high transaction costs but will probably also require time and strategy for negotiating a good deal like the previous options.

However, apart from choosing the relevant strategy of monetizing or commercializing an IP asset, what is also of great importance is proper due diligence and IP valuation before entering into any such deal. It is definitely a time consuming and laborious exercise but is still very necessary. Deficiency of the same opens up the relevant stakeholders to a lot of risk. There have been several cases in which the IP owner or in some cases even the buyer or licensee has suffered on account of a poorly done due diligence and valuation. In 1998, Volkswagen decided to buy the assets of Rolls Royce, including the brands ‘Rolls Royce’ and ‘Bentley’.

After they struck the deal for almost USD 900 million, they thought they had acquired exactly the assets they had expected to obtain. But in reality, although they got the factory and the facilities i.e. the physical assets, they only got the right to use the brands and the right to make and sell the Rolls Royce and Bentley vehicles for a limited time of 5 years and not the ownership.

In fact, the brands never belonged to Rolls Royce Motor Company with whom they had a deal, they belonged to Rolls Royce Plc the mother company. The parent company was more interested in transferring these rights to their competition BMW, which they did the 5 years term of the agreement was over. So, Volkswagen ended up paying a lot more than what they received in return resulting in a loss for them.

It is therefore pertinent for both the licensor and the licensee or the buyer and the seller to do their homework properly before the finalise the strategy of milking their IP assets.

Gitanjali is currently working as Head of Intellectual Property - Patents & Designs at Godrej & Boyce Mfg. Co. Ltd. She is a lawyer-cum-engineer with over 13 years of experience in the field of Intellectual Property. In her present role, she handle all aspects of patents and designs for all business units of Godrej & Boyce, including innovation protection, strategy, litigation and contentious matters, licensing and commercialization, IP contracts and agreements as well as awareness and training.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved