or

We are living in the knowledge society or as Peter Drucker called the ‘Post- Capitalist Society’. Unlike the capitalist society created by the allocation of capital and labour, knowledge society is created by productivity and innovation. Anyone, not just the ones with capital resources, could work towards enhancing productivity and innovate new things, thereby contributing towards the overall development of the self and of the society. The intellectual property system in the country helps them protect their innovations under patents, copyright, trademark, designs and other intellectual property rights. Once protected as IP rights, innovators would seek capital infusion to convert their IP rights into business ventures and integrate such IP rights into the business as an asset.

The balance sheet of any business organization presents, as on any particular date, assets that it owns and liabilities that it owes. Historically, in the capitalist society, the tangible assets comprising of land, building, machinery, vehicles, stock-in-trade, cash, etc., represented the major portion of assets held by the business (around 85% in 1950s). Today, the proportion of such tangible assets in the overall assets has reduced to around 25% (in 2010s), and the rest is accounted by intangible assets including IP assets. In a recent study conducted by Ocean Tomo, the intangible assets represent almost 84% of the total assets of the business. Despite this, managers today are not equipped to manage IP assets effectively. Except for few professionally qualified personnel, business organizations do not even have the skills required to value IP assets to be represented on its balance sheet.

There are universally accepted IP valuation techniques like the cost method, the market method, and the income method. Without understanding the nature of the IP assets involved and the purpose for which IP assets are to be valued, one cannot adopt these techniques to value IP assets. The IP assets are non-rivalrous assets and can be assigned and used by multiple parties simultaneously. They are characterized by large fixed costs and minimal marginal costs; the development of a patented drug costs a lot of initial investment, but requires minimal marginal cost to produce every additional unit of the drug. They demonstrate network effects and benefit from being a part of a network; a greater number of people adopts a particular software program, the more beneficial it would be for every user. Securing the ownership of IP assets is difficult and time consuming. Investing towards the creation of such IP assets could be risky, as the grant of the IP rights could be contingent upon various factors most of which may not be under the control of the innovator. Managing IP assets is also difficult because the infringement of such IP assets could go unnoticed; this leads to unintended outsiders benefiting from the investment made towards such IP assets. And predominantly, the IP assets do not have an established secondary market to trade in them, which poses a lot of challenge for the valuation of IP assets. Each of these features of IP assets plays a crucial role in its valuation, which we shall discuss later.

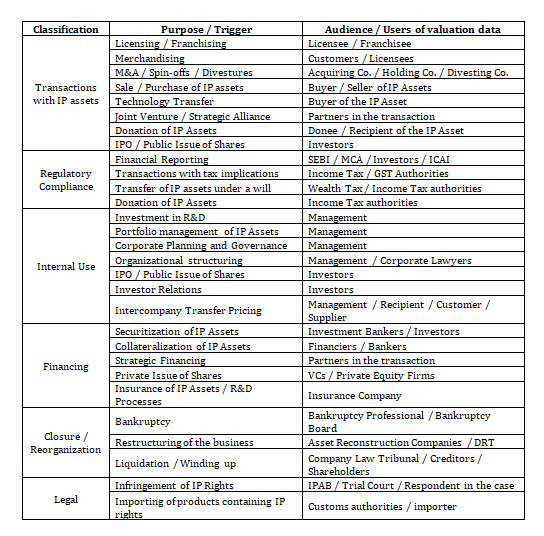

Valuation of IP assets is not a usual affair in the business and is carried out for a specific purpose based on some triggers. Such triggers could be internal or external. The following table provides a summary of the purpose or triggers for conducting the valuation of IP assets and the audience or users of such IP asset valuation data.

Once triggered by these reasons, business organizations would have their IP assets valued using appropriate techniques and the best mode to transact in those IP assets. The value of the IP asset would depend on the strength and validity of such IP assets, which could be ascertained through a rigorous due diligence process. The due diligence report and the valuation report for the IP assets have to be complemented with an appropriate business strategy decision, in order to achieve the best results from the exercise on valuing IP assets.

Dr. Nithyananda is currently working as a Faculty Member at the Indian Institute of Management Tiruchirappalli, Tamil Nadu, India, where he teaches electives like Strategic Management of Intellectual Property Rights, Business Models for Managing Intellectual Property Rights, and Legal Aspects of Marketing apart from the core course of Legal Aspects of Business. He earned his PhD in the area of intellectual property and its management from the National Law School of India University, Bangalore. He is also trained at the Harvard Business School on effective management teaching using business cases and business simulation. He has designed a simulation-based course “Strategic Management of Intellectual Property Rights”, which he has been teaching at various institutions and universities at France, Malaysia, Singapore, and Sri Lanka for the last 7-8 years. He has also trained working executives and management professionals on Managing Intellectual Property Assets, which is an area he is very passionate about.

Lex Witness Bureau

Lex Witness Bureau

For over 10 years, since its inception in 2009 as a monthly, Lex Witness has become India’s most credible platform for the legal luminaries to opine, comment and share their views. more...

Connect Us:

The Grand Masters - A Corporate Counsel Legal Best Practices Summit Series

www.grandmasters.in | 8 Years & Counting

The Real Estate & Construction Legal Summit

www.rcls.in | 8 Years & Counting

The Information Technology Legal Summit

www.itlegalsummit.com | 8 Years & Counting

The Banking & Finance Legal Summit

www.bfls.in | 8 Years & Counting

The Media, Advertising and Entertainment Legal Summit

www.maels.in | 8 Years & Counting

The Pharma Legal & Compliance Summit

www.plcs.co.in | 8 Years & Counting

We at Lex Witness strategically assist firms in reaching out to the relevant audience sets through various knowledge sharing initiatives. Here are some more info decks for you to know us better.

Copyright © 2020 Lex Witness - India's 1st Magazine on Legal & Corporate Affairs Rights of Admission Reserved